In the grand symphony of finance, great investors take center stage as the rock stars of the financial world. Their stories resonate not just with personal wealth accumulation but also with the millions of individuals who have followed in their footsteps, seeking to replicate their extraordinary returns. Within this elite cadre of financial virtuosos, divergence reigns supreme. Each investor, from innovators employing cutting-edge analyses to intuitive pickers trusting their instincts, brings a unique melody to the market. Yet, the common thread binding them is the unwavering ability to consistently outperform the market, earning them a place in the pantheon of investment legends. In this exploration of financial virtuosity, we uncover the diverse strategies and philosophies that define the success stories of these investment maestros.

Warren Buffett: The Oracle of Omaha

Warren Buffett, often referred to as the Oracle of Omaha, stands as a paragon of value investing. As the chairman and CEO of Berkshire Hathaway, Buffett’s investment philosophy revolves around identifying companies with enduring competitive advantages and strong fundamentals. His sage advice, encapsulated in aphorisms like “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1,” reflects his emphasis on capital preservation and the importance of a long-term perspective. Notably, Buffett’s astute investment in American Express in 1964, following a scandal, exemplifies his knack for recognizing value and capitalizing on market mispricings.

Benjamin Graham: The Father of Value Investing

Regarded as the Father of Value Investing, Benjamin Graham’s intellectual legacy has profoundly shaped the investment landscape. His groundbreaking book, “The Intelligent Investor,” laid the foundation for value investing principles. Graham emphasized the importance of intrinsic value and the margin of safety, teaching investors to approach the market with a disciplined and rational mindset. Graham’s own success was exemplified by his investment in Northern Pipeline during the 1920s, a strategic move that showcased his ability to identify opportunities during times of financial distress. His enduring influence is evident in the many investors, including Warren Buffett, who have adopted and adapted his principles for their own success.

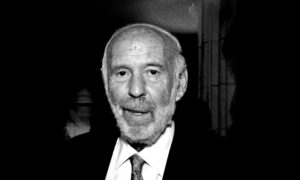

George Soros: The Global Macro Maestro

George Soros, a luminary in the world of finance, has earned his place as a global macro investor par excellence. His investment philosophy revolves around understanding and anticipating macroeconomic trends to make bold market moves. Soros became a household name after “Black Wednesday” in 1992 when he famously shorted the British pound, earning him approximately $1 billion and showcasing the influence a single individual could have on global financial markets. Soros’ reflexivity theory, which explores the interplay between market prices and investor behavior, adds depth to his macroeconomic approach, making him a figure whose insights are sought after in the realm of global finance.

Peter Lynch: The Master of Common-Sense Investing

Peter Lynch, with his down-to-earth and commonsensical approach to investing, achieved remarkable success during his tenure managing the Fidelity Magellan Fund. Lynch advocated for individual investors to invest in what they know, emphasizing thorough research on individual stocks. His mantra, “Go for a business that any idiot can run – because sooner or later, any idiot probably is going to run it,” reflects his preference for straightforward, well-managed companies. Lynch’s investment in Dunkin’ Brands during its IPO exemplifies his ability to identify promising opportunities early on and ride the wave of their long-term success.

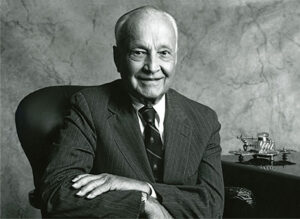

John Templeton: The Contrarian Visionary

John Templeton, a trailblazer in the world of investing, distinguished himself through his contrarian approach and global perspective. Templeton’s investment philosophy centered on seeking opportunities in undervalued and overlooked assets. His contrarian strategy was exemplified in post-World War II Japan, where he saw potential for growth amid economic challenges. By investing in Japanese equities during this period, Templeton showcased the rewards of thinking differently from the prevailing market sentiment. His commitment to global diversification and long-term investing principles has left an enduring legacy in the investment community.

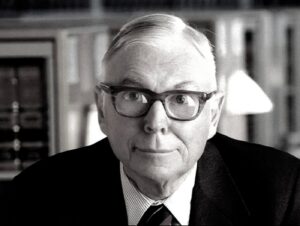

Charlie Munger: The Multidisciplinary Investor

Charlie Munger, the longtime business partner of Warren Buffett, is renowned for his intellectual acumen and multidisciplinary approach to investing. Munger’s investment philosophy aligns closely with Buffett’s value investing principles, but he brings an additional layer of wisdom by incorporating insights from various disciplines. His emphasis on mental models and the importance of understanding multiple fields of knowledge has shaped his decision-making process. Munger’s investment in Wesco Financial during the 1970s reflected his ability to navigate diverse industries successfully, showcasing the power of a well-rounded and adaptable mindset in the world of investing.

1 Comment