Peter Lynch, a legendary figure in the world of finance, is renowned for his exceptional career as a successful investor and his groundbreaking contributions to investment philosophy. In 2006, Boston Magazine named Lynch in the top 50 wealthiest Bostonians ranking him 40th with an overall net worth of $352 million USD. From his early life in Newton, Massachusetts, to managing the iconic Magellan Fund at Fidelity, Lynch’s journey has been marked by resilience, strategic acumen, and a unique approach to investing. In this blog post, we delve into the life, accomplishments, investment strategy, and philanthropic endeavors of Peter Lynch.

Early Life and Education

Born in 1944, Peter Lynch’s early experiences were shaped by personal tragedy and a strong work ethic. The death of his father at the age of ten prompted Lynch’s entry into the workforce as a caddy, sparking his initial interest in the stock market. A caddy scholarship paved the way for his education at Boston College, where he graduated in 1965 with a degree in finance. Lynch’s foray into the investment world began with a summer stint at Fidelity, leading to a full-time position as a textiles and metals analyst at the age of 25.

Notable Accomplishments

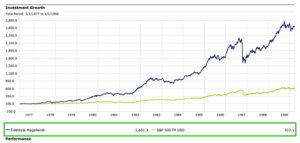

Lynch’s crowning achievement was taking over the Magellan Fund in 1977, transforming it into a powerhouse that consistently outperformed the S&P 500. Under his leadership, the fund’s assets grew from $20 million to a staggering $14 billion. Lynch’s mantra of “Buy what you know” became synonymous with his investment philosophy, emphasizing the importance of understanding the companies in which one invests. His success at Magellan Fund and dedication to active management made him a beacon for investors seeking superior returns.

Published Works

Beyond his role as an investor, Lynch shared his insights through three bestselling books: “One Up on Wall Street” (1989), “Beating the Street” (1994), and “Learn to Earn” (1995). Co-authored with John Rothchild, these books provide practical guidance for investors, encouraging them to leverage their knowledge and intuition to achieve financial success. Lynch’s accessible writing style and real-world examples resonate with both novice and seasoned investors.

Legacy

Peter Lynch’s impact on the investment landscape extends to his creation of the price-to-earnings-growth (PEG) ratio.

The PEG ratio, or Price/Earnings to Growth ratio, is a valuation metric used by investors to assess whether a stock is overvalued or undervalued, taking into account both its price-to-earnings (P/E) ratio and its expected earnings growth rate. The formula for calculating the PEG ratio is as follows:

Here’s a breakdown of the components:

- P/E Ratio (Price-to-Earnings Ratio): This is a measure of how much investors are willing to pay for each dollar of earnings. It is calculated by dividing the current market price per share by the earnings per share (EPS). The formula for the P/E ratio is:

- Earnings Growth Rate: This represents the anticipated rate at which a company’s earnings are expected to grow. The growth rate is usually expressed as a percentage and is often based on analysts’ forecasts or historical growth trends.

The resulting PEG ratio provides a more comprehensive assessment of a stock’s valuation compared to the standalone P/E ratio. A PEG ratio of 1 is generally considered fair value, indicating that the market is pricing the stock in line with its expected earnings growth. A PEG ratio below 1 may suggest that the stock is undervalued relative to its growth prospects, while a PEG ratio above 1 may indicate potential overvaluation.

Investors should be cautious when using the PEG ratio, as it has limitations. It relies on future earnings growth estimates, which may not always be accurate. Additionally, different analysts may use varying growth rate assumptions, leading to different PEG ratios for the same stock. Despite these limitations, the PEG ratio can be a valuable tool when used in conjunction with other fundamental and technical analyses to make more informed investment decisions.

His belief in the ability of individual investors to outperform institutional giants has inspired many to adopt a bottom-up approach to stock selection. Lynch’s legacy is not only evident in the financial world but also in his philanthropic endeavors alongside his wife Carolyn, who founded the Lynch Foundation in 1988.

Philanthropy

Established in 1988, the Lynch Foundation, founded by Peter and Carolyn Lynch, serves as a conduit for their philanthropic endeavors, focusing on education, Roman Catholic missions, the preservation of culture and history, and health and wellness. Mirroring Peter’s investment strategy, the foundation adheres to the principle of investing in areas that resonate personally, anticipating substantial rewards.

In 1999, Peter and Carolyn demonstrated their commitment to education by generously gifting $10 million to Peter’s alma mater, Boston College. This significant contribution marked a historic moment for the institution, representing the largest donation since its inception. In recognition of their generosity, the college bestowed a distinctive honor by naming their School of Education the Lynch School of Education.

A decade later, in 2010, the Lynch family’s dedication to educational advancement in Massachusetts manifested once again with a generous donation of $20 million to Boston College. This substantial contribution facilitated the establishment of the Lynch Leadership Academy, furthering the family’s mission to enhance educational opportunities in the region.

In a remarkable philanthropic milestone in 2021, Peter Lynch continued his legacy of generosity towards Boston College. From his and his late wife’s private collection, he contributed over $20 million worth of art, including invaluable Pablo Picasso paintings, to Boston College’s McMullen Museum of Art. Additionally, a $5 million grant accompanied this remarkable art donation, further enriching the university’s cultural resources. Through these generous gifts, Peter Lynch continues to play a pivotal role in shaping the educational and cultural landscape of Boston College, leaving an enduring legacy for generations to come.

The Peter Lynch Approach to Investing

The Peter Lynch Approach to Investing is characterized by a nuanced and pragmatic philosophy that encourages investors to engage with companies they can comprehend thoroughly. Lynch’s strategy goes beyond mere financial metrics, placing a significant emphasis on understanding a company’s narrative or “story” and its growth potential. This approach is rooted in the belief that a well-grounded expectation concerning a company’s growth prospects can lead to informed investment decisions.

Lynch categorizes stocks into six distinct types, each reflecting different attributes and growth trajectories.

- Slow Growers, for instance, represent large, aging companies expected to grow marginally faster than the overall economy.

- Stalwarts, on the other hand, are large companies still capable of growth with annual earnings growth rates around 10% to 12%.

- Fast-Growers are small, aggressive firms with substantial annual earnings growth of 20% to 25%.

- Cyclicals exhibit sales and profit patterns influenced by economic cycles.

- Turnarounds are companies experiencing revitalization after facing challenges.

- Asset Opportunities involve companies with overlooked assets, requiring investors to recognize hidden value.

Lynch’s meticulous selection criteria involve a comprehensive analysis of various financial metrics. Earnings stability and consistency are scrutinized through a review of year-by-year earnings, providing insights into the company’s financial strength. The growth rate of earnings is considered in alignment with the firm’s story, with Lynch cautioning against unsustainable high growth rates. Price-earnings ratios are utilized to evaluate a company’s current price in relation to its most recent earnings, and this is further examined in comparison to historical averages and industry benchmarks.

Additionally, Lynch’s evaluation includes the crucial debt-to-equity ratio, indicating the financial leverage of a company. Net cash per share, a measure of financial strength, is calculated by considering cash and cash equivalents minus long-term debt, providing an indication of the company’s ability to navigate expansions or challenges. Dividend-related metrics, such as the payout ratio and dividend yield, are considered for dividend-paying firms.

This thorough and multifaceted approach underscores Lynch’s commitment to diligent research and understanding the fundamentals of the companies he invests in. By considering a range of factors beyond traditional financial metrics, Lynch aims to create a well-rounded and informed perspective, aligning with his belief that individual investors can achieve success by investing in what they know and by getting to know the companies in their portfolios intimately.

Related Article: How to Use Stock Screeners to Find Investment Opportunities

Portfolio Building and Monitoring

Lynch’s bottom-up approach encourages investors to focus on stocks they are familiar with, rather than blindly diversifying. While Lynch managed a large portfolio at Magellan, he cautioned against over-diversification, stressing the importance of in-depth research and familiarity with chosen investments. Lynch advocates long-term commitment to the stock market, discouraging market timing. His strategy involves regular portfolio reviews, ensuring that the reasons for initially investing in a stock remain valid.

Conclusion

Peter Lynch’s enduring legacy as an investor, author, and philanthropist reflects his exceptional contributions to the world of finance. His unwavering belief in the potential of individual investors, coupled with his pragmatic approach to stock selection, has left an indelible mark. As the vice chairman of Fidelity and an active philanthropist, Lynch continues to inspire a new generation of investors to embrace the principles of “investing what you know” and approaching the market with a discerning eye.

1 Comment