Benjamin Graham was a British-born American financial analyst, investor, and professor. He is widely known as the “father of value investing” and is considered one of the most influential figures in the history of modern investment theory.

Graham’s investment philosophy emphasizes the importance of fundamental analysis and long-term investing. He believed that investors should focus on buying stocks that are trading below their intrinsic value, which is the company’s true underlying worth. His approach contrasted with the prevailing market sentiment of his time, which was often driven by speculation and short-term momentum.

Early Life and Education

Benjamin Graham had an early life marked by both academic brilliance and financial hardship.

Born Benjamin Grossbaum in London in 1894, his family immigrated to New York City when he was just a toddler. Their financial security took a hit during the Bank Panic of 1907, and tragically, his father passed away around the same time. These events instilled in Graham a deep understanding of the value of a dollar.

Despite the challenges, Graham excelled in school. His sharp mind earned him a scholarship to Columbia University, where he entered at the young age of 16. He graduated an impressive second in his class at the age of 20, all within three and a half years. Columbia even offered him a teaching position.

However, driven by the need to support his family, Graham chose the path of Wall Street. He started his career in 1914 at the firm of Newburger, Henderson and Loeb, taking a $12 per week job to begin building his financial future.

Achieving financial success early, by 25 he was making a half-million dollars a year, Graham was then hit hard by the 1929 Stock Market Crash. This experience, where he lost nearly everything, proved to be a valuable learning experience about investing. Fueled by these insights, he co-authored, with David Dodd, the influential investment book “Security Analysis.” They were also joined by Irving Kahn, another highly respected investor, who contributed to the book’s research.

Graham’s exceptional academic performance and early foray into Wall Street set the stage for his remarkable career as an investor, author, and instructor who would leave a lasting impact on the world of finance.

What is Value Investing?

Value investing is a stock market strategy focused on buying stocks that appear to be undervalued by the market. Investors who use this approach believe that by buying these discounted stocks, they can potentially profit when the market price eventually catches up to the stock’s true worth. Here’s a breakdown of the key concepts:

Undervalued Stocks

The core of value investing lies in identifying stocks trading for less than their intrinsic value. Intrinsic value is essentially the company’s true worth, considering its financials, assets, future earnings potential, and overall business health. Value investors believe market sentiment and short-term fluctuations can cause stocks to deviate from their intrinsic value.

Benjamin Graham actually proposed two methods for estimating a stock’s intrinsic value:

Graham Number: This is a simpler formula that considers both a company’s earnings and book value. It takes the square root of 22.5 times the product of EPS (earnings per share) and BVPS (book value per share). The number 22.5 reflects Graham’s belief that a fair P/E ratio shouldn’t be over 15 and the price-to-book ratio shouldn’t exceed 1.5 (15 x 1.5 = 22.5).

Earnings and Growth Formula: This is a more nuanced approach that factors in a company’s earnings potential. The original formula is:

- Intrinsic value = EPS x [(8.5 + (2 x Expected annual growth rate, g))]

Here, EPS represents the trailing twelve months earnings per share, and the bracketed term is a multiplier that considers both a base valuation for a non-growing company (8.5) and a factor for expected growth (2g).

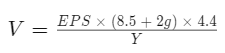

In 1974, the formula was revised to include both a risk-free rate of 4.4% which was the average yield of high grade corporate bonds in 1962 and the current yield on AAA corporate bonds represented by the letter Y:

It’s important to remember that these formulas are starting points for value investors. Graham emphasized the concept of a “margin of safety,”.

Margin of Safety

Value investing emphasizes buying stocks with a margin of safety. This means the difference between the current market price and the investor’s estimate of the stock’s intrinsic value. Buying stocks when the market price is significantly lower than the calculated intrinsic value and selling them when the market corrects itself and both the prices converge and finally intersect each other. A larger margin of safety provides a buffer against potential miscalculations or market downturns.

Fundamental Analysis

Value investors rely heavily on fundamental analysis to assess a stock’s intrinsic value. This involves analyzing financial statements, such as income statements and balance sheets, to understand the company’s profitability, financial health, and future growth prospects. Ratios like price-to-earnings (P/E) and price-to-book (P/B) are commonly used to compare a stock’s price to its underlying fundamentals.

Contrarian Approach

Value investors often take a contrarian approach, meaning they go against the prevailing market sentiment. When the market is euphoric and driving stock prices up, value investors might be looking to sell their existing holdings or hold off on new purchases. Conversely, during market downturns, when pessimism might lead to undervalued stocks, value investors might become active buyers.

Long-Term Perspective

Value investing is a long-term investment strategy. The core idea is to buy undervalued stocks, hold them for the long haul, and profit as the market recognizes their true worth. Value investors are patient and believe that over time, the market will correct itself, and undervalued stocks will eventually rise in price.

Benjamin Graham Books

- Security Analysis (1934): Co-authored with David Dodd, this is a seminal work on value investing that outlines Graham and Dodd’s investment philosophy. This book laid the foundation for modern security analysis and introduced key concepts like the margin of safety and the distinction between investment and speculation. It emphasizes the importance of fundamental analysis and teaches investors how to identify undervalued stocks.

- The Interpretation of Financial Statements (1937): This book teaches investors how to read and understand financial statements. This is essential for any investor who wants to be able to value companies.

- The Intelligent Investor (1949): This is Graham’s most famous book and is considered the bible of value investing. This book outlines Graham’s investment philosophy and provides a practical guide for individual investors. It teaches investors how to think rationally about the stock market and avoid emotional decision-making. Graham introduces the concept of Mr. Market, an irrational investor who offers to buy or sell stocks to you each day. The book also discusses the importance of margin of safety and how to find undervalued stocks.

Here are some of the key learnings from Benjamin Graham’s books:

- The stock market is cyclical: The stock market will go up and down over time. Investors should not try to time the market, but instead focus on buying stocks that are undervalued and holding them for the long term.

- Intrinsic value vs. market price: There is a difference between the intrinsic value of a stock (what it is worth) and the market price (what people are willing to pay for it). Value investors try to buy stocks that are trading for less than their intrinsic value.

- Mr. Market: The stock market is like a manic-depressive investor who offers to buy or sell stocks to you each day. Sometimes Mr. Market will be euphoric and offer to sell you stocks at a high price. Other times he will be depressed and offer to sell you stocks at a low price. The intelligent investor takes advantage of Mr. Market’s mood swings by buying stocks when he is depressed and selling them when he is euphoric.

- Margin of safety: When you buy a stock at a significant discount to its intrinsic value, you have a margin of safety. This margin of safety helps to protect you from losing money if the stock price goes down.

Legacy of Benjamin Graham

Benjamin Graham’s impact goes beyond his writings. His time as a professor at Columbia Business School had a profound effect on a generation of investors, with Warren Buffett being the most prominent example. Here’s a deeper look at this mentorship and its lasting influence:

Buffett’s Transformation: A young Buffett stumbled upon Graham’s book “The Intelligent Investor” and was captivated by its value investing principles. He actively sought to learn from Graham at Columbia, and this mentorship significantly shaped Buffett’s investment philosophy.

Core Principles Embraced: Buffett became a devoted student of Graham’s approach. He embraced concepts like value investing, focusing on a company’s fundamentals and intrinsic value rather than just market price. This emphasis on finding undervalued stocks with a margin of safety became a cornerstone of Buffett’s investing strategy.

Beyond the Textbook: Graham likely wasn’t just teaching investment strategies, but also an overall approach to the market. Buffett has mentioned Graham’s advice to “do something foolish, something creative, and something generous” every day. This suggests Graham instilled not just financial wisdom, but also a well-rounded perspective.

Lasting Legacy: Buffett’s incredible success as an investor serves as a testament to the effectiveness of Graham’s teachings. The fact that Buffett, widely considered one of the greatest investors (as of January 2024, the eighth wealthiest man in the world valued at almost $120.6 billion) ever, continues to credit Graham’s principles as core to his strategy speaks volumes about the enduring influence of Graham’s mentorship.

Graham’s mentorship extended beyond Buffett. Other successful investors like Irving Kahn, Walter Schloss, and Joel Greenblatt all learned from Graham at Columbia. This group of successful value investors is sometimes referred to as the “Graham Dodd Disciples” due to Graham’s collaboration with David Dodd on “Security Analysis.”

Although Benjamin Graham died in 1976, his work lives on and is still widely used by value investors and financial analysts running fundamentals on a company’s prospect for value and growth.

Benjamin Graham Quotes

Here are 10 insightful quotes by Benjamin Graham on investing and value:

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” – This quote emphasizes buying undervalued stocks during pessimistic times.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – This highlights that market fluctuations are temporary, and intrinsic value prevails in the long run.

“A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price.” – This reminds investors to focus on the underlying business value, not just the stock price.

“People who invest make money for themselves; people who speculate make money for their brokers.” – This quote differentiates between investing for long-term value and short-term speculation.

“While enthusiasm may be necessary for great accomplishments elsewhere, on Wall Street, it almost invariably leads to disaster.” – This emphasizes the importance of a rational and unemotional approach in investing.

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” – This defines Graham’s value investing philosophy, prioritizing capital preservation and reasonable returns.

“To achieve satisfactory investment results is easier than most people realize; to achieve superior results is harder than it looks.” – This acknowledges that a well-defined strategy can lead to good results, but achieving exceptional returns requires significant skill.

“The market is there for you to exploit its folly, not to join its madness.” – This highlights the potential to capitalize on market irrationality through value investing.

“Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal.” – This emphasizes using market volatility to your advantage by buying undervalued assets.

“Obvious prospects for physical growth in a business do not translate into obvious profits for investors.” – This reminds investors to focus on a company’s financial health, not just its growth potential.

Related Links:

2 Comments