Market sentiment refers to the overall attitude or feeling of market participants (investors, traders, analysts, etc.) toward a particular financial market or asset. It reflects the collective emotions and opinions of market participants regarding the direction in which prices are likely to move. Market sentiment can play a significant role in influencing price movements and can be driven by a variety of factors, including economic indicators, news events, geopolitical developments, and other external influences.

Three main types of market sentiment

- Bullish Sentiment: This occurs when investors and traders are optimistic about the market’s future prospects, expecting prices to rise. Positive economic data, favorable earnings reports, and overall confidence in the market can contribute to bullish sentiment.

- Bearish Sentiment: Conversely, bearish sentiment occurs when market participants are pessimistic, anticipating that prices will decline. Negative economic indicators, disappointing earnings reports, or concerns about geopolitical events can contribute to bearish sentiment.

- Neutral Sentiment: Neutral sentiment reflects a lack of strong conviction or a balanced view among market participants. It may occur during periods of uncertainty or when there is a lack of clear catalysts influencing the market.

Traders and analysts often use various tools and indicators to gauge market sentiment, such as sentiment surveys, options data, social media sentiment analysis, and technical analysis. Understanding market sentiment can help investors make more informed decisions, as it provides insights into the prevailing mood of the market and potential future price movements.

Indicators used to Measure Market Sentiment

Several indicators are commonly used to measure market sentiment. These indicators help investors and traders assess the prevailing mood in the market and make informed decisions. Here are some key indicators used to measure market sentiment:

High-Low Index

The High-Low Index is used to measure market sentiment, particularly in terms of the number of stocks reaching new highs or new lows. This indicator provides insights into the strength or weakness of a market trend. Here’s how it works:

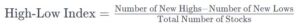

- The High-Low Index is calculated by taking the difference between the number of stocks reaching new highs and the number of stocks reaching new lows and dividing this by the total number of stocks.

- A positive High-Low Index indicates that more stocks are reaching new highs than new lows, suggesting a positive market sentiment and strength in the current trend.

- Conversely, a negative High-Low Index suggests that more stocks are reaching new lows than new highs, indicating a potentially bearish sentiment and weakness in the market.

- Traders and analysts often use the High-Low Index to confirm the strength of a trend. For example, a rising market with a high High-Low Index may indicate broad market participation in the upward move.

- It’s essential to consider the High-Low Index in conjunction with other indicators to get a more comprehensive view of market sentiment and trend strength.

The High-Low Index is particularly useful in assessing the breadth of a market move, providing insights into whether the trend is supported by a wide range of stocks or if it’s limited to a few specific securities.

Bullish Percent Index

The Bullish Percent Index (BPI) is used to measure market sentiment, particularly within the context of point and figure chart analysis. The Bullish Percent Index helps assess the percentage of stocks in a particular market or index that is currently exhibiting bullish price patterns. Here’s how it works:

- The Bullish Percent Index is calculated by taking the number of stocks in an index or market that currently have bullish point and figure chart patterns and expressing it as a percentage of the total number of stocks in that index.

- Bullish point and figure chart patterns typically indicate a positive outlook for those individual stocks.

- The Bullish Percent Index ranges from 0 to 100, where 0 indicates that none of the stocks have bullish patterns, and 100 indicates that all stocks have bullish patterns.

- A high Bullish Percent Index suggests a market where a significant percentage of stocks are in bullish trends, indicating overall positive sentiment.

- Conversely, a low Bullish Percent Index suggests a market where fewer stocks are exhibiting bullish patterns, signaling potential bearish sentiment.

- Traders and investors use the Bullish Percent Index to gauge the overall health of a market or sector. It can help identify potential shifts in market sentiment and assess the breadth of a trend.

- It’s important to note that like any indicator, the Bullish Percent Index is not foolproof, and it should be used in conjunction with other tools and analyses for a more comprehensive understanding of market conditions.

By examining the Bullish Percent Index, market participants can gain insights into the internal strength or weakness of a market, helping them make more informed decisions about potential entry or exit points.

Volatility Index (VIX)

The Volatility Index, often referred to as the VIX, is a key indicator used to measure market sentiment, specifically the market’s expectation of future volatility. The VIX is often considered the “fear gauge” because it tends to rise during periods of market uncertainty and decline during calmer, more optimistic times. Here’s how it works:

- The VIX is calculated based on the prices of options on the S&P 500 index, which is a broad representation of the U.S. stock market.

- The VIX reflects the market’s expectations for future volatility over the next 30 days. A higher VIX indicates a higher expected level of volatility, suggesting increased uncertainty and potential market turbulence.

- Traders and investors use the VIX as a measure of market sentiment because elevated volatility often accompanies market declines, while low volatility can indicate a more stable or bullish market environment.

- The VIX is expressed in percentage points and is often interpreted as follows:

- A VIX below 20 is generally associated with low volatility and a more complacent or bullish market sentiment.

- A VIX between 20 and 30 may indicate moderate market uncertainty.

- A VIX above 30 is often viewed as a sign of heightened market fear and increased volatility, potentially signaling a more bearish sentiment.

- Some traders use the VIX as a contrarian indicator, meaning that extremely low VIX levels might suggest complacency and an overheated market, while extremely high VIX levels might indicate fear and potential buying opportunities.

- It’s important to note that the VIX is not a direct measure of market direction but rather a measure of expected volatility. As such, it should be used in conjunction with other indicators and analyses for a comprehensive understanding of market conditions.

Monitoring the VIX can provide valuable insights into investor sentiment and help traders and investors anticipate potential changes in market conditions, enabling them to adjust their strategies accordingly.

Related Article: The Role of Fear and Greed in the Stock Market

Moving Averages

Moving averages are widely used indicators in technical analysis to measure trends and smooth out price data. They are effective tools for assessing market sentiment by providing insights into the overall direction and strength of a market or asset. Here’s an overview of how moving averages can be used as indicators of market sentiment:

- Moving averages are calculated by taking the average price of an asset over a specified time period, and they help smooth out short-term fluctuations in price data.

- Two common types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The EMA gives more weight to recent prices, making it more responsive to short-term price changes compared to the SMA.

- The use of different time periods for moving averages can reveal different aspects of market sentiment. For example:

- A short-term moving average (e.g., 20-day) reacts quickly to recent price changes and is useful for assessing short-term trends.

- A long-term moving average (e.g., 200-day) provides a broader perspective on the overall trend and is often used to identify the primary trend.

- Golden Cross and Death Cross: Crossovers between short-term and long-term moving averages are significant events in technical analysis. A “Golden Cross” occurs when a short-term moving average crosses above a long-term moving average, suggesting a potential bullish trend. Conversely, a “Death Cross” occurs when a short-term moving average crosses below a long-term moving average, indicating a potential bearish trend.

- Slope and Distance from Price: The slope of a moving average can indicate the strength of the current trend. If the moving average is rising, it suggests a bullish sentiment, while a declining moving average may indicate a bearish sentiment. The distance between the price and a moving average can also provide insights into the strength of the current trend.

- Moving averages are versatile and can be applied to various timeframes, making them valuable tools for traders and investors with different investment horizons.

By analyzing moving averages, market participants can gain a better understanding of prevailing trends, potential trend reversals, and the overall sentiment in the market. Moving averages are often used in combination with other technical indicators to form a comprehensive analysis of market conditions.

There are also some other ways to measure market sentiment. They are as following:

Sentiment Surveys:

- Investor Sentiment Surveys: Surveys conducted by various financial institutions and organizations, such as the American Association of Individual Investors (AAII) or the Investors Intelligence survey, provide insights into the opinions and attitudes of individual investors.

- Analyst Recommendations: Tracking the recommendations and ratings of financial analysts can give an indication of the overall sentiment toward a particular stock or market.

Options Market Data:

- Put-Call Ratio: The put-call ratio compares the number of put options (bearish bets) to call options (bullish bets) traded in the options market. A high put-call ratio may suggest bearish sentiment, while a low ratio may indicate bullish sentiment.

- Implied Volatility: Changes in implied volatility, derived from options pricing models, can reflect shifts in market sentiment. Higher implied volatility often corresponds to increased uncertainty and potential market declines.

Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Extreme readings may indicate a potential reversal in sentiment.

Advance-Decline Line: The advance-decline line tracks the number of advancing and declining stocks in a market index. A strong advance-decline line may suggest positive market breadth and bullish sentiment.

Sentiment Analysis Tools: Analyzing social media platforms, news articles, and financial blogs using sentiment analysis tools can provide insights into the general sentiment of the investing community.

Consumer Confidence Index: Consumer confidence surveys can offer insights into the sentiment of the broader population, which can influence economic and market expectations.

It’s essential to note that no single indicator can provide a complete picture of market sentiment. Traders and investors often use a combination of these indicators to form a more comprehensive understanding of the prevailing sentiment and make more informed decisions. Additionally, market sentiment can be dynamic and subject to rapid changes based on new information and events.

Related Video Link: From Bullish to Bearish: Market Sentiment

Trading Strategies Based on Market Sentiment

Trading strategies based on market sentiment involve making trading decisions by analyzing and interpreting the collective mood of market participants. Traders use various indicators and tools to gauge sentiment and then formulate strategies accordingly. Here are some common trading strategies based on market sentiment:

- Trend Following:

- Strategy: Follow the prevailing trend indicated by market sentiment.

- Indicators: Moving averages, trendlines, and trend-confirming technical indicators.

- Implementation: Enter long positions during bullish sentiment and short positions during bearish sentiment. Use trend-following indicators to confirm the strength and direction of the trend.

- Contrarian Investing:

- Strategy: Take positions opposite to the prevailing sentiment.

- Indicators: Contrarian indicators such as the Volatility Index (VIX), extreme sentiment readings, or overbought/oversold indicators.

- Implementation: Buy when sentiment is excessively bearish and sell when sentiment is overly bullish. Contrarian investors believe that extreme sentiment often leads to market reversals.

- News and Event Trading:

- Strategy: React to news and events that trigger shifts in sentiment.

- Indicators: Economic calendars, news sentiment analysis tools, and event-driven indicators.

- Implementation: Take positions based on the impact of significant news or events on market sentiment. This strategy requires quick decision-making and is often used by short-term traders.

- Option Strategies:

- Strategy: Use options to implement sentiment-based strategies.

- Indicators: Options data, put-call ratios, and implied volatility.

- Implementation: Construct option strategies such as buying protective puts during bearish sentiment or selling covered calls during bullish sentiment. Option strategies allow traders to express views on volatility and direction.

- Breadth Analysis:

- Strategy: Assess market breadth to gauge the strength of a trend.

- Indicators: Advance-decline lines, new highs and lows, and the Bullish Percent Index.

- Implementation: Confirm the strength of a trend by analyzing the number of advancing versus declining stocks. Strong market breadth supports the prevailing sentiment.

- Sentiment Surveys:

- Strategy: Utilize sentiment survey data to inform trading decisions.

- Indicators: Investor sentiment surveys, analyst recommendations, and social media sentiment.

- Implementation: Trade in the direction indicated by sentiment surveys. For example, if retail investors are overwhelmingly bullish, consider potential contrarian positions.

- Volatility Trading:

- Strategy: Trade based on expectations of volatility changes.

- Indicators: Volatility Index (VIX), Bollinger Bands, and historical volatility.

- Implementation: Buy options or implement volatility-based strategies during periods of expected increased volatility. Sell options or implement strategies to benefit from lower volatility during calmer periods.

It’s important to note that market sentiment can be dynamic, and traders should use a combination of indicators and risk management techniques. Additionally, no strategy guarantees success, and market conditions can change rapidly. Traders should continuously adapt their strategies based on evolving sentiment and market dynamics.

2 Comments