Ray Dalio is a name synonymous with financial success. As the founder of Bridgewater Associates, the world’s largest hedge fund, Dalio has built a career on bold moves and innovative thinking. But his story goes beyond billion-dollar deals. It’s a tale of starting small, embracing radical transparency, and building a company culture unlike any other.

Early Life and Education

Born in Queens, New York in 1949, Raymond Thomas Dalio wasn’t necessarily the most studious student. However, he possessed a keen curiosity, particularly when it came to making money. At the young age of 12, while caddying for golfers, Dalio started picking up investment tips.

With his newfound knowledge, Dalio took his first plunge into the market. Using $300, he bought shares in Northeast Airlines. When the airline merged, the stock price soared, tripling his investment. This early success fueled his desire to learn more. By high school, Dalio had built a small but impressive portfolio worth several thousand dollars, a significant sum for a teenager in the late 1960s.

While his academic record wasn’t exceptional, Dalio’s passion for finance secured him a spot at C.W. Post College of Long Island University. There, he continued to buy and sell stocks, but his interest also shifted towards commodity futures. The lower margin requirements in futures trading appealed to Dalio, who saw it as a way to leverage his limited capital for potentially high returns.

Dalio’s dedication to finance landed him a spot at Harvard Business School. After graduating with an MBA in 1973, he took a chance and launched his own investment firm, Bridgewater Associates, from his New York City apartment just two years later in 1975.

Notable Trades by Ray Dalio

Ray Dalio isn’t just known for his hedge fund’s massive size. He’s also celebrated for his unconventional investment strategies and some truly remarkable trades. While details of Bridgewater’s specific holdings are typically kept confidential, here’s a look at some of Dalio’s most noteworthy maneuvers:

The Chicken McNugget and the Birth of Risk Parity:

One of Dalio’s lesser-known but impactful trades involved…chicken! In the early days of Bridgewater, Dalio identified a concern for McDonald’s with their upcoming Chicken McNugget launch. The worry? Fluctuating chicken prices could squeeze their profit margins. Dalio, with his deep understanding of the livestock, grain, and oilseed markets, proposed a solution using futures contracts. This innovative approach allowed chicken producers to fix their own costs, ensuring a stable price for McDonald’s – a win-win for both parties. This experience, according to Dalio, became a cornerstone of his “risk parity” strategy, which emphasizes diversification across asset classes with low correlation.

Predicting the 2008 Crisis

Dalio’s ability to identify and capitalize on economic trends is another hallmark of his success. In the years leading up to the 2008 financial crisis, many investors were swept up in the housing market frenzy. Bridgewater, however, saw the warning signs. By strategically shorting certain assets and using other risk-mitigation techniques, Dalio positioned his firm to not only weather the storm but potentially profit from it. This prescient move solidified Bridgewater’s reputation as a leader in macro investing.

The All Weather Portfolio

One of Dalio’s most well-known investment philosophies is embodied in the “All Weather” portfolio. This strategy prioritizes diversification across various asset classes, aiming to perform well in any economic environment. It includes a mix of stocks, bonds, commodities, and even gold. While the specific allocations are a closely guarded secret, the core principle of diversification across asset classes with different risk profiles is a cornerstone of Bridgewater’s investment approach.

The Takeaway: Beyond the Headlines

These are just a few examples of Ray Dalio’s notable trades. It’s important to remember that successful investing is often about a combination of factors, including deep market analysis, calculated risk-taking, and a long-term perspective. While we may not have access to the specifics of Bridgewater’s trades, Dalio’s approach offers valuable insights for investors of all levels. By focusing on diversification, understanding economic trends, and managing risk, investors can navigate the ever-changing markets with greater confidence.

Ray Dalio Books

Ray Dalio is a prolific writer who shares his investment philosophies and life experiences through several publications. Here’s a breakdown of his notable published work:

-

Principles: Life and Work (2017): This New York Times bestseller is Dalio’s magnum opus. It outlines his core principles for achieving success in both personal and professional spheres. The book delves into topics like radical transparency, embracing mistakes as learning opportunities, and surrounding yourself with talented people.

-

Principles for Navigating Big Debt Crises: This book focuses on Dalio’s insights into understanding and potentially profiting from economic downturns. It likely explores historical debt crises and proposes strategies for navigating similar situations.

-

Principles for Dealing with the Changing World Order: Why Nations Succeed or Fail: This work expands Dalio’s focus beyond individual or corporate success. Here, he likely examines how nations rise and fall based on their economic and political structures, potentially offering his perspective on navigating the complexities of the global landscape.

-

Principles: Your Guided Journal (Create Your Own Principles to Get the Work and Life You Want): This companion piece to “Principles: Life and Work” serves as a practical tool. It provides prompts and exercises to help readers develop their own set of principles for achieving their goals.

Philanthropy

Ray Dalio, along with his family, are known for their extensive philanthropic efforts. Here’s a breakdown of their giving:

-

Dalio Philanthropies: Established in 2003, this family foundation serves as the umbrella organization for their charitable work. Dalio Philanthropies focuses on a wide range of causes, reflecting the diverse interests of the Dalio family members.

-

Focus Areas: Some of the key areas Dalio Philanthropies supports include:

- Education: They believe in creating equal opportunity through better access to quality education. This includes initiatives in early childhood education and supporting institutions focused on innovation in learning.

- Health: Health equity is a major focus, with Dalio Philanthropies supporting organizations that address disparities in healthcare access. They’ve also created the Dalio Center for Health Justice at New York-Presbyterian Hospital to expand access to quality care.

- Ocean Exploration and Protection: Protecting the world’s oceans is a passion for Ray Dalio. Dalio Philanthropies funds OceanX, a research organization dedicated to exploring and understanding the oceans.

- Financial Inclusion: They support organizations that promote financial self-sufficiency, particularly through microfinance initiatives that empower entrepreneurs.

- Other Causes: The Dalio family’s philanthropy extends to other areas like social entrepreneurship, mental health, and meditation.

-

Philanthropic Approach: The Dalio family views their philanthropy as a “family activity” and actively participate in grantmaking decisions. They prioritize organizations that align with their core values of creating equal opportunity and fostering positive change.

-

Financial Commitment: Since its inception, Dalio Philanthropies has provided over $6 billion in support of their various initiatives. This demonstrates their long-term commitment to making a significant impact through their giving.

Ray Dalio All Weather Portfolio

The All-Weather Portfolio, popularized by Ray Dalio, is designed to perform well in various economic climates. Here’s a breakdown of how to build one:

Investment Allocation:

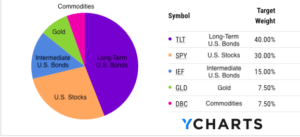

The core principle of the All-Weather Portfolio lies in diversification across asset classes with historically low correlations. Here’s the traditional allocation:

- 30% U.S. Stocks: This provides exposure to equities and potential for long-term growth. You can achieve this through a broad-market stock index fund like the Vanguard Total Stock Market ETF (VTI).

- 40% Long-Term U.S. Government Bonds: These bonds offer stability and income during economic downturns. Consider a long-term Treasury bond ETF like the iShares 20+ Year Treasury ETF (TLT).

- 15% Intermediate-Term U.S. Government Bonds: These offer a balance between risk and return compared to long-term bonds. Look into intermediate-term Treasury bond ETFs like the iShares 7-10 Year Treasury ETF (IEF).

- 7.5% Commodities: Commodities can act as a hedge against inflation. You can access this through a broad commodity index fund like the SPDR Gold Shares ETF (GLD) or a basket of commodity ETFs.

- 7.5% Gold: Gold is another hedge against inflation and market volatility. Consider including a gold ETF like the SPDR Gold Shares ETF (GLD).

Important Considerations:

- Rebalancing: The All-Weather Portfolio requires periodic rebalancing to maintain the target asset allocation. As market fluctuations cause percentages to drift, buy or sell assets to bring them back in line with the desired percentages.

- Risk Tolerance: This portfolio is designed for a moderate risk tolerance. If you have a higher or lower risk tolerance, you might need to adjust the allocation percentages.

- Investment Time Horizon: The All-Weather Portfolio is intended for a long-term investment horizon (10+ years). Short-term fluctuations are less concerning when you have a long time for the portfolio to recover.

- Fees and Costs: Pay attention to expense ratios when choosing ETFs. Lower expense ratios mean you keep more of your returns.

Alternatives and Resources:

- There are variations of the All-Weather Portfolio with different asset class allocations. Research and choose one that aligns with your risk tolerance and investment goals.

- Consider consulting with a financial advisor to discuss if the All-Weather Portfolio is suitable for your individual circumstances.

- Several online resources offer detailed explanations and variations of the All-Weather Portfolio. Be sure to get information from reputable sources.

Remember, the All-Weather Portfolio is a strategy, not a guarantee of perfect performance. It involves some risk and requires ongoing management. Do your research and make informed decisions before investing.

1 Comment