The Dot-Com Bubble of the late 1990s and its subsequent burst between 2000 and 2002 marked a significant chapter in financial history, characterized by the rapid rise and fall of U.S. technology stock equity valuations. The dot-com bubble was fueled by a surge in investments in Internet-based companies during the bullish market of the late 1990s.

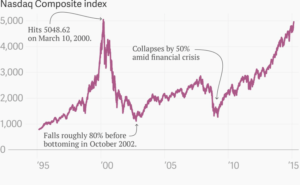

During this period, the value of equity markets experienced exponential growth, particularly on the technology-dominated Nasdaq index, which soared from under 1,000 to over 5,000 between 1995 and 2000. However, in 2000, the tide began to turn, and the bubble burst, triggering a bear market for equities that persisted into 2002.

The Nasdaq index, which had witnessed a five-fold increase between 1995 and 2000, suffered a precipitous fall from a peak of 5,048.62 on March 10, 2000, to 1,139.90 on October 4, 2002—a staggering 76.81% decline. This downturn resulted in a loss of billions of dollars for investors, and by the end of 2001, most dot-com stocks had become virtually worthless. Even blue-chip technology stocks like Cisco, Intel, and Oracle saw their share prices plummet by more than 80%.

The burst of the dot-com bubble had far-reaching consequences, leading to the collapse of several Internet companies. Many startups, driven by speculative and fad-based investing, had spent lavishly on marketing and advertising, often without a clear path to profitability. Record amounts of capital flowed into the Nasdaq, and by 1999, 39% of all venture capital investments were directed toward Internet companies.

The bubble burst as capital began to dry up, exposing the lack of sustainable business models for many dot-com companies. The Nasdaq’s peak on March 10, 2000, marked a turning point, with panic selling triggered by massive sell orders from leading high-tech companies. Dot-com companies, previously valued in the hundreds of millions, became virtually worthless within months, and by the end of 2001, a majority of publicly-traded dot-com companies had folded.

The aftermath of the dot-com bubble burst prompted regulatory scrutiny, highlighting the risks associated with speculative investing and the importance of sound business fundamentals. While the bubble had severe consequences, it also paved the way for surviving companies like Amazon, eBay, and Priceline to emerge as long-term successes. It took 15 years for the Nasdaq to regain its peak, a process that was completed on April 24, 2015.

The dot-com bubble and its subsequent burst serve as a cautionary tale about the dangers of excessive speculation, the importance of sustainable business models, and the need for prudent investment practices in the dynamic landscape of technology-driven markets.

Causes of the Dot-Com Bubble Burst (2000-2002)

1. Speculative Investments in Internet-related Companies

Unprecedented Surge in Investor Enthusiasm

- During the late 1990s, there was a remarkable surge in investor enthusiasm and optimism surrounding companies associated with the internet and technology. The rapid growth of the internet fueled excitement about the potential for these companies to revolutionize industries and create new business opportunities.

- Investors, driven by the fear of missing out (FOMO) on potential gains, were eager to participate in what seemed like a transformative era for technology. This enthusiasm led to a speculative frenzy, with many investors rushing to allocate capital to internet-related companies.

Frenzied Rush to Invest

- The dot-com bubble was characterized by a frenzied rush to invest in any company associated with the internet, regardless of whether they had a solid business model, proven revenue streams, or profitability. Investors were captivated by the promise of the internet’s potential to reshape industries and deliver astronomical returns.

- Start-up companies with little or no earnings were able to attract substantial investment based solely on the perception of being part of the burgeoning internet revolution.

Lack of Clear Understanding

- A significant contributing factor to the bubble was the lack of a clear understanding among investors about the business models and financial fundamentals of many internet-related companies. The excitement and hype surrounding these companies often overshadowed rational analysis, leading to speculative decision-making.

- Investors, driven by speculative fervor, were willing to invest in companies with unproven concepts and uncertain paths to profitability, assuming that the sheer association with the internet would lead to success.

2. Overvaluation of Tech Stocks

Soaring Valuations to Unsustainable Levels

- The valuations of many technology and internet-related stocks experienced an unprecedented ascent, reaching levels that were fundamentally unsustainable. Traditional valuation metrics, such as price-to-earnings ratios, were often disregarded as investors were willing to pay exorbitant prices for shares of these companies.

- The prevailing belief was that traditional measures of valuation were no longer relevant in the “new economy,” where the internet was expected to drive limitless growth and redefine business models.

Ignored Fundamental Metrics

- Investors, caught up in the excitement of the dot-com era, frequently ignored fundamental metrics that traditionally guided investment decisions. Companies with little or no earnings were given astronomical valuations based on the expectation of future profitability.

- The market became detached from the underlying financial health and earnings prospects of the companies. Investors were more focused on the potential for exponential growth rather than the fundamental metrics that typically underpin stock valuations.

Overheated Market

- The collective enthusiasm and speculative buying led to an overheated market, where stock prices were inflated beyond reasonable valuations. The disconnect between stock prices and the actual financial performance of companies created a bubble that was destined to burst.

- The overvaluation set the stage for a significant market correction, as the inflated prices could not be sustained by the actual earnings and revenue generation of the companies.

The causes of the Dot-Com Bubble Burst were rooted in speculative investments driven by unprecedented enthusiasm for internet-related companies. The frenzied rush to invest and the overvaluation of tech stocks, detached from traditional valuation metrics, created a bubble that eventually burst, leading to a significant market correction.

How the Dot-Com Bubble Burst (2000-2002) Happened

1. Bankruptcies of Dot-Com Companies

Financial Challenges and Operating at a Loss

- As the dot-com bubble burst, the speculative fervor that had fueled the rapid rise of internet-related stocks evaporated. Investors, realizing the overvaluation and unsustainable nature of many dot-com companies, began reassessing their investment strategies.

- Many of the internet-related companies faced financial challenges. A significant number of these companies were operating at a loss, relying heavily on venture capital funding and stock market capitalization to sustain their operations. The lack of profitability became a significant concern as investors shifted their focus from speculation to financial viability.

Dependency on Venture Capital and Stock Market Capitalization

- Dot-com companies, especially those in the early stages of development, were often dependent on external funding, primarily from venture capital investors. The optimism that had attracted substantial venture capital funding began to wane as investors became more discerning about the sustainability of business models.

- Additionally, the reliance on stock market capitalization as a source of funding became problematic when the stock prices of these companies started to plummet. The erosion of market capitalization negatively impacted the ability of these companies to raise additional capital through stock offerings.

Shift in Investor Sentiment and Drying Up of Funding

- The bursting of the dot-com bubble marked a significant shift in investor sentiment. As reality set in, investors became more risk-averse and began to scrutinize the financial health and prospects of the companies in which they had invested.

- With the reassessment of risk, funding for many dot-com companies dried up. Venture capital investors became more cautious, and the willingness to continue injecting capital into companies with uncertain paths to profitability diminished.

Bankruptcies and Sharp Decline in Stock Prices

- The drying up of funding sources led to a wave of bankruptcies among dot-com companies. Many of these companies, unable to secure the necessary capital to sustain operations, went out of business.

- The financial struggles and bankruptcies of dot-com companies had a cascading effect on the stock market. The burst of the bubble resulted in a sharp decline in the stock prices of these companies, causing significant losses for investors who had participated in the speculative frenzy.

2. Market Correction

Triggering a Substantial Market Correction

- The bankruptcies of numerous dot-com companies triggered a substantial market correction. The correction was not limited to the technology sector; it extended to the broader market indices. The burst of the dot-com bubble had a profound impact on investor confidence and market dynamics.

Sharp Decline in Stock Prices

- Stock prices, especially in the technology sector, experienced a sharp decline as investors rapidly sold off their holdings. The correction reflected a reevaluation of the valuations that had been driven by speculation rather than fundamental financial metrics.

- The decline in stock prices was not confined to internet-related stocks; it affected a broad range of companies as investors reassessed risk and adjusted their portfolios accordingly.

Repercussions Beyond Internet-related Stocks

- The bursting of the dot-com bubble had repercussions beyond the internet-related stocks. The correction extended to other sectors as well, reflecting a more cautious and risk-averse investor sentiment.

- The broader market correction was a consequence of the interconnectedness of financial markets, where the fallout from the burst of the bubble had a domino effect, impacting various industries and market segments.

The Dot-Com Bubble Burst led to the bankruptcies of many internet-related companies, particularly those operating at a loss and heavily reliant on external funding. The shift in investor sentiment and the drying up of funding sources triggered a substantial market correction, marked by a sharp decline in stock prices, especially in the technology sector, and extending to broader market indices.

Recovery from the Dot-Com Bubble Burst (2000-2002)

1. Diversification and Growth in Other Sectors

Gradual Recovery

- The recovery from the dot-com bubble burst was gradual, marked by a shift in investor sentiment and a reevaluation of investment strategies. As the excesses of the technology and internet-related bubble became apparent, investors sought to diversify their portfolios and reduce exposure to high-risk, speculative assets.

Move Away from High-Risk Investments

- Investors began to move away from the high-risk, speculative investments that had characterized the dot-com era. Recognizing the need for a more balanced and diversified approach, they shifted their attention to other sectors that offered more stable and sustainable growth prospects.

Growth in Alternative Sectors

- Other sectors, such as finance, healthcare, and energy, experienced growth during the recovery period. Investors turned their attention to industries with more established business models, solid fundamentals, and a track record of delivering consistent returns.

- The diversification into alternative sectors contributed to the overall recovery of the stock market and the broader economy. Investors sought opportunities in areas that were less prone to the volatility and uncertainty associated with speculative bubbles.

2. Emergence of New Technologies

Surviving Tech Companies Adapted

- The burst of the dot-com bubble had a profound impact on many technology companies, leading to a wave of bankruptcies and financial struggles. However, some tech companies survived by adapting to the new market realities. They adjusted their business models, focused on profitability, and addressed the lessons learned from the speculative excesses of the bubble.

Innovative Startups Capitalized on Lessons Learned

- The aftermath of the dot-com bubble provided valuable lessons for entrepreneurs and investors. Innovative startups emerged, capitalizing on the lessons learned from the burst of the bubble. These startups adopted more sustainable and realistic business models, emphasizing profitability and addressing the fundamental needs of consumers.

Evolution of the Technology Sector

- Over time, the technology sector evolved, and new trends gained prominence. Mobile computing, e-commerce, and social media emerged as transformative forces, reshaping how businesses operated and how people interacted. These new technologies attracted renewed investor interest and contributed to economic growth.

Renewed Investor Interest

- As the technology sector adapted and embraced more sustainable practices, investor confidence in the sector was gradually restored. The emergence of new technologies and innovative business models created opportunities for growth, attracting capital and investment.

Legacy and Impact

- The recovery from the dot-com bubble burst left a lasting legacy in shaping investor behavior and the technology landscape. The emphasis on diversification, prudent investment strategies, and a focus on fundamentals became guiding principles for investors.

- The evolution of the technology sector demonstrated its resilience and ability to adapt. Lessons learned from the dot-com era influenced a more cautious and realistic approach to investing in technology, with an emphasis on companies with sound business models and sustainable growth prospects.

- The recovery also highlighted the cyclical nature of financial markets and the importance of learning from past market excesses. The dot-com bubble and its aftermath served as a reminder of the risks associated with speculative investing and the need for a balanced and diversified approach to building resilient portfolios.

Lessons from the Dot-Com Bubble Burst (2000-2002)

1. Emphasis on Fundamental Valuation

Shift from Speculative Investing to Fundamental Analysis

- The dot-com bubble taught investors a crucial lesson about the importance of fundamental valuation. The euphoria of the late 1990s had led to a speculative investing frenzy where the future potential of companies was often prioritized over their current financial health. The burst of the bubble prompted a significant shift in focus.

- Investors began to realize the need for a more careful and comprehensive evaluation of a company’s financial health, earnings, and business model. The emphasis shifted from speculative bets solely based on future potential to a more rigorous analysis grounded in fundamental factors.

Wary of Inflated Valuations

- Investors learned to be wary of stocks with inflated valuations. The experience of the dot-com era underscored the risks associated with overvalued stocks, where market prices were detached from the underlying financial performance of companies.

- Traditional financial metrics, such as price-to-earnings ratios and earnings growth, regained significance in the decision-making process. Investors became more discerning, seeking investments that aligned with reasonable valuations based on fundamentals.

2. Diversification

Risks of Concentrated Investments

- The bursting of the dot-com bubble highlighted the inherent risks of concentrated investments in a single sector. Many investors had experienced significant losses due to their heavy exposure to technology and internet-related stocks.

- Investors learned the importance of diversifying their portfolios to spread risk and reduce vulnerability to the impact of a downturn in any particular industry. Diversification became a key strategy to protect portfolios from extreme volatility and uncertainty associated with speculative bubbles.

Mitigating Industry-specific Downturns

- Diversification was recognized as a crucial risk-management tool. By holding a diversified portfolio across different sectors and asset classes, investors could mitigate the impact of industry-specific downturns. The goal was to achieve a balance that reduced overall portfolio risk while maintaining opportunities for returns.

3. Caution About Investing in Speculative, High-risk Assets

Cautionary Tale of Speculative Investing

- The dot-com bubble served as a cautionary tale about the perils of investing in speculative, high-risk assets without a solid understanding of the underlying businesses. The burst exposed the vulnerabilities of companies with weak business models, lack of profitability, and unsustainable growth strategies.

- Investors learned that the pursuit of quick gains through speculative investments could lead to significant losses. The experience underscored the importance of a prudent and cautious approach to investing.

Discernment and Due Diligence

- The burst of the dot-com bubble reinforced the importance of conducting thorough due diligence before making investment decisions. Investors became more discerning, seeking companies with proven business models, sustainable growth prospects, and a clear path to profitability.

- The experience emphasized the need for a comprehensive understanding of the companies in which investors were considering placing their capital. This approach aimed to avoid the pitfalls of investing in companies driven primarily by hype and speculation.

Legacy and Impact

- The lessons from the dot-com bubble burst had a lasting impact on investor behavior and market dynamics. Fundamental valuation, diversification, and caution about speculative, high-risk assets became guiding principles for investors seeking to build resilient and well-balanced portfolios.

- These lessons influenced a more thoughtful and analytical approach to investing, fostering a culture of due diligence, risk management, and a focus on the long-term sustainability of companies. The dot-com era became a pivotal chapter in the evolution of investment practices, shaping the strategies employed by investors in subsequent market cycles.

Related Article: Top 10 Stocks to Watch in the US Market

Related Video Link: Dot-com bubble