Investing in the US stock market offers a wide range of opportunities for individuals looking to grow their wealth. However, with numerous investment strategies available, it can be challenging to determine which approach is the most suitable. In this article, we will explore various investment strategies for the US stock market to help investors make informed decisions.

Value Investing

The stock market can be a frenzy of excitement and fear. Hot trends emerge, then fizzle out just as quickly. In this whirlwind, value investing stands as a calm, calculated approach. It’s about seeking out undervalued companies with strong fundamentals, like a treasure hunter spotting a forgotten gem.

What is Value Investing?

At its core, value investing is about buying stocks for less than their intrinsic worth. Imagine a company like a business you own. Its true value comes from its future earnings potential, not just its current stock price. Value investors become detectives, analyzing a company’s financials, competitive advantage, and long-term prospects.

Why Value Investing?

The market can be fickle. Sometimes, excellent companies get overlooked, leading to undervalued stocks. A value investor pounces on these opportunities, buying low with the confidence that the stock price will eventually reflect the company’s true value.

The Value Investor’s Toolkit

There’s no magic formula, but value investors rely on a set of tools:

- Financial Ratio Analysis: Ratios like P/E (price-to-earnings) and P/B (price-to-book) help assess a company’s value relative to its earnings or assets.

- Competitive Advantage: What makes this company stand out? A strong brand, a unique product, or a dominant market position are all indicators of long-term potential.

- Margin of Safety: Value investors buy stocks with a significant discount to their intrinsic value. This buffer protects them if the market takes a downturn.

Value Investing: Not for the Faint of Heart

Value investing demands patience. The market may not recognize a company’s worth immediately. There can be periods where undervalued stocks remain under the radar. But for the disciplined investor, this is where the true rewards lie.

Getting Started with Value Investing

- Educate Yourself: Read books by Benjamin Graham, the father of value investing, and other greats like Warren Buffett.

- Practice Financial Analysis: Learn to read financial statements and calculate key ratios.

- Think Long-Term: Value investing is a marathon, not a sprint. Be prepared to hold stocks for several years.

Remember: Value investing isn’t a get-rich-quick scheme. It’s a time-tested strategy for building wealth through careful research and a disciplined approach. So, if you’re looking to navigate the market’s frenzy and uncover hidden gems, value investing might be the perfect treasure map for you.

Growth Investing

The world of investing can feel overwhelming, with countless strategies and jargon flying around. But if you’re an ambitious investor with a long-term horizon, growth investing might be a great fit for you.

What is Growth Investing?

Growth investing focuses on companies with the potential for explosive future growth. These companies are typically young, innovative, and disrupting their industries. They may not be turning a profit yet, but their focus is on reinvesting every dollar back into the business to fuel future earnings.

Why Consider Growth Investing?

The allure of growth investing is simple: the potential for outsized returns. By getting in on the ground floor with a future giant, you could see your investment multiply many times over. Growth stocks have historically outperformed the broader market, making them a tempting option for long-term investors.

Is Growth Investing Right for You?

Growth investing is not without its risks. These companies are often unproven, and their stock prices can be volatile. You’ll need a high tolerance for risk and the patience to weather the inevitable ups and downs.

Here are some signs you might be a good fit for growth investing:

- You have a long-term investment horizon (think 5+ years).

- You are comfortable with volatility and short-term price swings.

- You are excited by innovation and disruptive technologies.

Finding the Next Big Thing

So, how do you identify those future superstars? Here are some key things to look for:

- Strong Revenue Growth: Look for companies with a consistent and accelerating top line.

- Large Addressable Market: The company should be operating in a massive market with plenty of room for expansion.

- Competitive Advantage: What makes this company unique and defensible from competitors?

- Management Team: A strong and visionary leadership team is crucial for navigating the challenges of hyper-growth.

Remember: Growth investing is not a guaranteed path to riches. Do your research, understand the risks, and be prepared for the ride.

Related Articles:

Fundamental Analysis of Geron Corporation (GERN)

Fundamental Analysis of Laird Superfood (LSF)

Fundamental Analysis of Mobileye (MBLY)

Dividend Investing

The world of investing can be thrilling and intimidating at the same time. While the potential for growth is exciting, navigating the different strategies can feel overwhelming. But what if there was a way to earn regular income alongside long-term growth? Enter dividend investing, a strategy that might be perfect for you.

What are Dividends?

Dividends are a portion of a company’s profits that are paid out to shareholders. Think of it like a company sharing its success with you. These payouts can be made quarterly, annually, or even more frequently.

Why Consider Dividend Investing?

There are several reasons why dividend investing is a popular strategy:

- Passive Income: Dividends provide a steady stream of income, which can be reinvested to grow your portfolio further or used to supplement your current income.

- Focus on Stable Companies: Companies that pay dividends are typically established and financially secure, offering a potentially lower risk investment compared to high-growth startups.

- Long-Term Growth: While dividends provide current income, the underlying stocks can still experience price appreciation, offering total return potential.

Getting Started with Dividend Investment

Ready to explore dividend investing? Here are some key things to keep in mind:

- Do Your Research: Don’t just chase the highest dividend yields. Look for companies with a history of consistent dividend payouts and strong financial health.

- Diversification is Key: Don’t put all your eggs in one basket. Spread your investments across different sectors and companies to minimize risk.

- Reinvesting Dividends: Consider reinvesting your dividends to automatically purchase more shares, accelerating your portfolio’s growth through compounding.

Resources for the Aspiring Dividend Investor

The world of dividend investing is vast, but there are plenty of resources available to help you on your journey. Here are a few to get you started:

- Websites: Sure Dividend, The Dividend Guy Blog, Simply Safe Dividends

- Books: “The Intelligent Investor” by Benjamin Graham, “The Drunken Millionaire” by William J. Bernstein

Remember, dividend investing is a long-term strategy. Don’t expect to get rich quick. By carefully selecting stocks, reinvesting your earnings, and staying patient, you can build a portfolio that provides a steady stream of income and grows over time.

Index Investing

Investing can feel like a complicated game. Analysts chatter about hot stocks, flashy financial products dazzle with promises, and the fear of missing out (FOMO) can cloud your judgment. But what if there was a way to invest that was simple, low-cost, and historically proven to deliver solid returns? Enter index investing.

What is Index Investing?

Imagine a giant basket containing all the apples in a grocery store. An index fund is like that basket, but instead of apples, it holds a collection of stocks (or bonds) that reflect a particular market segment, like the S&P 500 or the total stock market. When you invest in an index fund, you’re essentially buying a tiny piece of every company in that basket.

Why Choose Index Investing?

Here are some compelling reasons to consider index funds:

- Simplicity: Forget about trying to predict which stocks will outperform the market. Index funds track a specific market index, so your performance is automatically tied to the overall market’s growth.

- Low Cost: Index funds typically come with lower fees compared to actively managed funds. This means more of your money goes towards growing your wealth, not lining fund managers’ pockets.

- Diversification: By holding a basket of stocks, you spread your risk across different companies and industries. This helps protect your portfolio from downturns in any single sector.

- Long-Term Performance: Studies have shown that over time, index funds tend to outperform actively managed funds. This is because the market, as a whole, has historically trended upwards.

Is Index Investing Right for You?

While index investing offers a compelling set of advantages, it’s not a one-size-fits-all solution. Here are some things to consider:

- Investment Time Horizon: Index funds are ideal for long-term goals like retirement. The market can be volatile in the short term, but historically, it has trended upwards over longer periods.

- Risk Tolerance: While diversification helps, index funds still carry some inherent market risk. If you can’t stomach potential losses, you may need a more conservative investment strategy.

Getting Started with Index Investing

The good news is that getting started with index investing is easier than you might think. Here are some steps:

- Open an investment account: Many online brokerages offer commission-free trades on popular index funds.

- Choose your index funds: Consider your risk tolerance and investment goals when selecting index funds. Target broad market funds for a well-diversified portfolio.

- Invest consistently: Set up automatic contributions to your index funds, so you’re investing regularly regardless of market conditions.

The Bottom Line

Index investing is a powerful tool that can help you achieve your financial goals. It’s a simple, low-cost, and effective way to build wealth over the long term. So, ditch the stress of stock picking and embrace the power of the market with index funds. Remember, while past performance is not a guarantee of future results, history suggests that index investing can be a winning strategy for most investors.

Momentum Investing

Have you ever noticed a stock steadily climbing, then wished you’d hopped on that train a station earlier? That’s the basic idea behind momentum investing, a strategy that capitalizes on stocks with a history of strong performance.

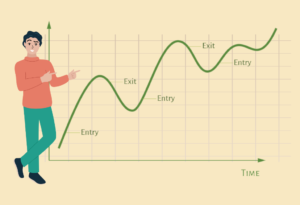

The core principle? Investors believe stocks that have been rising are likely to continue doing so. By identifying these stocks and buying in at the right time, you can potentially capture significant gains.

Why Does Momentum Work?

There are a few theories behind the success of momentum investing. One explanation is psychology. When a stock price rises, it attracts more attention and investors, pushing the price even higher. This creates a self-fulfilling prophecy, driving the stock further up.

Another theory focuses on information. Rising stock prices might signal that the company has strong fundamentals or positive developments on the horizon, not yet fully priced into the market.

How to Implement a Momentum Strategy

There’s no one-size-fits-all approach, but here are some general steps:

- Identify Uptrends: Look for stocks with a history of price increases over a specific period. This can involve technical analysis tools or simply studying price charts.

- Set Entry and Exit Points: Determine when to buy and sell. This could involve using technical indicators like moving averages or setting profit targets.

- Maintain Discipline: Momentum strategies can be volatile. Sticking to your plan and avoiding emotional decisions is crucial.

Important Considerations

While momentum investing can be lucrative, it’s not without risks:

- Volatility: Momentum stocks can experience sharp price swings. Be prepared for a bumpy ride.

- FOMO (Fear of Missing Out): Don’t chase fleeting trends. Ensure the stock has solid fundamentals before buying.

- False Signals: Technical indicators aren’t perfect, and momentum can fizzle out unexpectedly.

- Short-Term Focus: Momentum is best suited for short-term gains, not long-term investing goals.

Is Momentum Investing Right for You?

Momentum investing can be a valuable tool for active investors with a higher tolerance for risk. However, it’s essential to consider your investment goals, risk appetite, and overall investment strategy before incorporating momentum into your portfolio.

Remember: Momentum investing is just one piece of the puzzle. A well-diversified portfolio that considers factors like value and growth alongside momentum is often recommended for long-term success.

Want to Learn More?

This blog post is just a starting point. If you’re interested in exploring momentum investing further, consider researching technical analysis indicators and consulting with a financial advisor to determine if this strategy aligns with your investment goals.

Contrarian Investing

The financial world thrives on a herd mentality. Investors chase hot trends, piling into sectors and stocks experiencing meteoric rises. But what if there’s a smarter way to navigate the market? Enter contrarian investing, a strategy that flips the script and seeks profits by going against the grain.

What is Contrarian Investing?

Imagine everyone rushing to sell a particular stock. Panic is in the air, fueled by negative headlines. A contrarian investor sees this as a potential buying opportunity. They believe the market has overreacted, creating a temporary discount on an asset with strong fundamentals.

Why Go Against the Crowd?

There are several reasons why contrarian investing can be a successful strategy:

- Market Overreactions: Investor sentiment can be fickle. Fear and greed can lead to irrational buying and selling, creating opportunities for contrarians to capitalize on mispriced assets.

- Focus on Value: By looking past short-term noise, contrarians can identify undervalued stocks with long-term potential.

- Discipline and Patience: Contrarian investing requires a strong stomach and a long-term perspective. You might have to hold onto an investment while it’s out of favor, waiting for the market to catch up to its true value.

Famous Contrarians

Some of the most successful investors in history were contrarians. Think Warren Buffett, who famously said, “Be fearful when others are greedy, and greedy when others are fearful.” These investors understand the power of unemotional analysis and the potential rewards of going against the popular narrative.

Is Contrarian Investing Right for You?

Contrarian investing isn’t for everyone. It requires a strong understanding of financial markets, a tolerance for risk, and the ability to think independently. It’s also crucial to do your own research and not blindly follow every contrarian whim.

Here are some tips for aspiring contrarian investors:

- Develop a strong investment thesis: Don’t just buy because everyone else is selling. Have a clear rationale for your contrarian view.

- Manage risk carefully: Contrarian bets can go wrong. Diversify your portfolio and invest only what you can afford to lose.

- Be patient: Markets can be slow to recognize value. Don’t expect instant gratification.

Remember: Contrarian investing isn’t about being stubborn or contrarian for the sake of it. It’s about having the courage to challenge conventional wisdom and identify hidden opportunities in the market.

Related Article: Sir John Templeton: The Contrarian Investor

Conclusion

In conclusion, exploring different investment strategies for the US stock market can help investors find an approach that suits their objectives. Whether it’s value investing, growth investing, dividend investing, index investing, momentum investing or contrarian investing, each strategy has its own merits and considerations. By understanding these strategies and their underlying principles, investors can make well-informed decisions and navigate the complexities of the US stock market.

Overall, the US stock market offers a diverse range of investment opportunities, and investors can choose from various strategies to achieve their financial goals. It is important to carefully evaluate each strategy’s risks, rewards, and compatibility with individual circumstances before making investment decisions. Additionally, seeking professional advice or conducting thorough research can provide valuable insights and enhance the effectiveness of the chosen investment strategy.

Remember that investing in the stock market involves inherent risks, including the potential for loss of capital. Therefore, it is crucial to conduct due diligence, diversify investments, and maintain a long-term perspective. Regularly monitoring and adjusting your portfolio based on changing market conditions can help optimize investment outcomes.

4 Comments