ClearOne is a communication solutions provider specializing in audio and visual technologies for conferencing, collaboration, and network streaming. They cater to various applications, from classrooms and businesses to residential settings.

Financials:

- Revenue: Q3 2023 revenue was $4.9 million, down from $6.3 million in Q3 2022 and $5.5 million in Q2 2023.

- Gross Profit: Q3 2023 gross profit was $1.6 million, with a margin of 33%. This represents a slight improvement sequentially but a decrease year-over-year.

- Operating Expenses: Operating expenses decreased sequentially and year-over-year due to cost-cutting measures.

- Net Loss: GAAP net loss increased slightly year-over-year to $(1.4) million due to the revenue decline.

- Balance Sheet: Cash and investments significantly improved to $20.0 million at the end of Q3 2023 compared to $1.0 million at the end of 2022.

- Debt: The company has a relatively small amount of debt, with $1.2 million outstanding on senior convertible notes.

Recent News (as of November 9th, 2023):

- ClearOne reported a decrease in revenue for Q3 2023 compared to both Q3 2022 and Q2 2023. They attribute this mainly to product shortages and a slowdown in sales orders.

- The company completed its manufacturing transition from China to Singapore and expects this to improve product availability.

- ClearOne launched new products, including the Versa USB22D Dante Adapter and the DIALOG UHF Wireless Microphone System, which received positive recognition from the industry.

- The company remains focused on cost optimization and has a more efficient operating model.

Strengths:

- Strong brand recognition: ClearOne is a well-established player in the audio and visual communication solutions market.

- Strong customer base: Google, Volkswagen, Facebook, Disney, Apple, Samsung, Kraft, 3M, Morgan Stanley and Harvard University.

- Product innovation: Recent product launches like Versa USB22D Dante Adapter and DIALOG UHF Wireless Microphone System demonstrate a commitment to innovation.

- Improved cost structure: Operating expenses have decreased due to cost-cutting measures.

- Strong balance sheet: Increased cash and equivalents provide a financial cushion.

Weaknesses:

- Reliance on manufacturing partners: Transitioning manufacturing from China to Singapore caused temporary product shortages and revenue decline.

- Limited product diversification: Revenue heavily relies on core audio conferencing and beamforming microphone arrays.

- Negative profitability: The company is yet to achieve sustained profitability.

Opportunities:

- Growing demand for AV solutions: The market for audio-visual communication solutions is expected to grow due to the increasing adoption of remote work and hybrid learning environments.

- New product launches: Upcoming product launches like DIALOG UHF could contribute to future revenue growth.

- Market share expansion: ClearOne can leverage its brand recognition and cost optimization to gain market share.

Threats:

- Competition: The AV market is highly competitive, with established players and new entrants vying for market share.

- Economic slowdown: A global economic downturn could decrease demand for AV solutions.

- Supply chain disruptions: Future disruptions in the global supply chain could impact production and delivery.

Future Outlook:

ClearOne is taking steps to address its weaknesses. The company is focusing on completing its manufacturing transition, ramping up production of new products, and expanding its product portfolio. While recent quarters have shown a decline in revenue, the improved cost structure and strong balance sheet position the company for potential future growth. However, competition and potential economic headwinds pose significant challenges.

Investment Thesis:

Investing in CLRO involves a degree of risk due to the current financial performance. However, the company’s efforts to improve production and launch new products could lead to future growth. Investors should closely monitor the company’s progress in resolving production issues and regaining profitability.

Additional Points to Consider:

- This analysis is based solely on the information provided in the press release. Further research, including financial statements and industry reports, is recommended before making any investment decisions.

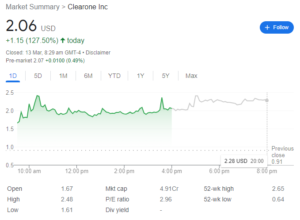

- The recent stock price surge due to the special dividend should be considered when evaluating the company’s overall valuation.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please consult with a financial professional before making any investment decisions.

Additional Resources:

- Investor Relations – https://investors.clearone.com/

- Press Releases – https://investors.clearone.com/press-releases

Related Links:

Fundamental Analysis of Discover Financial Services (DFS)

Fundamental Analysis of Spirit AeroSystems (SPR)

Fundamental Analysis of Ocugen Inc (OCGN)

Fundamental Analysis of Mobileye (MBLY)