Spirit AeroSystems Holdings, Inc., is an American aerostructure manufacturer. The company, based in Wichita, Kansas, builds several important pieces of Boeing aircraft, including the fuselage of the 737, and 787, as well as the flight deck section of the fuselage of nearly all of Boeing airliners.

Spirit AeroSystems (SPR) is a major player in the aerospace industry, specializing in manufacturing aerostructures for commercial and defense aircraft. It recently released its fourth-quarter 2023 results, showcasing some positive signs for the company’s future. Let’s delve into the recent financial performance and conduct a SWOT analysis to understand SPR’s potential.

Financials (Q4 2023)

- Revenue: Positive news. Revenue increased year-over-year in Q4 2023, driven by higher production deliveries and the Boeing Memorandum of Agreement (MOA) impact.

- Earnings: Mixed bag. EPS improved compared to Q4 2022 due to the Boeing MOA. However, forward loss reversals related to the 787 program masked underlying profitability.

- Cash Flow: Tight but improving. Cash flow from operations turned positive in Q4 2023, with free cash flow at $42 million. The company also raised capital through stock issuance.

- Backlog: Strong backlog of $49 billion indicates future revenue potential.

- 2024 Outlook: Uncertain due to pending decisions on Boeing 737 MAX production and ongoing price negotiations with Airbus.

Strengths

- Leading Market Position: Spirit is a major player in aerostructures, boasting a diverse client base like Airbus and Boeing.

- Diversified Customer Base: Serves both commercial and defense sectors, mitigating risk.

- Strong Backlog: A healthy backlog of $49 billion indicates strong future demand for Spirit’s products. Provides revenue visibility and future stability.

- Improved Profitability: The Boeing MOA and increased production suggest a path towards higher profitability. Recent adjustments have led to positive EPS.

- Strong Customer Base: Contracts with major players like Airbus and Boeing.

Weaknesses

- Reliance on Boeing: A significant portion of revenue comes from Boeing, making SPR vulnerable to their production decisions.

- Profitability Challenges: Despite the MOA’s impact, underlying profitability remains unclear due to forward loss reversals.

- Supply Chain Issues: Dependence on a few suppliers can expose Spirit to disruptions and price fluctuations.

- High Production Costs: Difficulty in controlling costs can squeeze margins.

Opportunities

- Increased Boeing Production: Potential Boeing 737 MAX production rate hikes could significantly boost revenue.

- Airbus Price Negotiations: Streamlining operations and favorable negotiations could improve margins on Airbus programs.

- Growth in Aftermarket: Increased demand for spare parts can be a steady revenue stream.

- Commercial Aerospace Growth: The recovering commercial aviation industry presents a growth opportunity.

- Expansion into New Markets: Diversification beyond commercial and defense sectors could mitigate risk.

Threats

- Competition: The aerostructures market is competitive, with players like Airbus potentially bringing production in-house.

- Economic Downturn: Reduced demand for aircraft during an economic slowdown could hurt revenue.

- Geopolitical Issues: Trade tensions or regional conflicts could disrupt supply chains.

- Boeing Negotiations: Ongoing price negotiations with Boeing could impact future profitability.

- Technological Advancements: New manufacturing technologies could disrupt SPR’s current processes.

Investment Decision

SPR’s recent financial performance shows signs of improvement, but challenges remain. The company’s dependence on Boeing and ongoing negotiations with Airbus are key factors to consider. Investors seeking exposure to the aerospace industry should carefully evaluate SPR’s risk-reward profile before making a decision.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please consult with a financial professional before making any investment decisions.

Spirit AeroSystems News

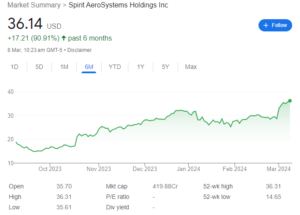

The most recent news regarding Spirit AeroSystems Inc. is that they are currently in discussions with Boeing about a possible acquisition. This news was confirmed by Spirit AeroSystems themselves on March 1, 2024. It is important to note that no agreements have been finalized and there is no guarantee a deal will be reached

Additional Resources

- Spirit AeroSystems Investor Relations: https://investor.spiritaero.com/corporate-profile/default.aspx

- Spirit AeroSystems Reports 2023 Results: https://www.spiritaero.com/pages/release/spirit-aerosystems-reports-2023-results/

Related Articles:

Fundamental Analysis of Discover Financial Services (DFS)

Fundamental Analysis of Ocugen Inc (OCGN)

Fundamental Analysis of Mobileye (MBLY)