The COVID-19 Pandemic Crash 2020 stands as a pivotal moment in financial history, characterized by unprecedented global market disruptions triggered by the outbreak of a highly contagious and deadly respiratory virus. Between February 20 and April 7, 2020, stock market indices worldwide experienced a rapid and severe decline, marking the onset of what can be unequivocally termed a stock market crash.

The COVID-19 pandemic, caused by the SARS-CoV-2 virus, resulted in an unparalleled public health crisis with far-reaching economic implications. The first known cases of the virus were reported in December 2019, and by early 2020, it had spread globally, prompting governments to implement stringent measures, including lockdowns and social distancing, to contain the disease. The resultant disruption in labor markets led to a contraction of GDP by as much as 25%, sending shockwaves through the global economy.

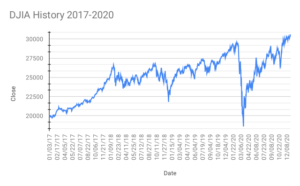

The stock market’s response to the pandemic was swift and dramatic. Over three days in March 2020, the New York Stock Exchange witnessed such severe selloffs that circuit breakers were activated, temporarily halting trading. The Dow Jones Industrial Average, a key indicator of market performance, experienced significant declines, including a record-setting drop of 9.9% on March 12, 2020. By March 16, the Dow had lost 3,000 points, wiping out another 12.9% of its value.

In total, the Dow Jones Industrial Average bottomed out with a staggering loss of 37% of its value in 2020, while the broader S&P 500 lost 34%. Global indexes, including the FTSE 100, DAX, and Nikkei, posted double-digit percentage declines.

The pandemic-induced crash had a clear correlation with the virus’s spread and the resulting disruption in economic activities. Lockdowns and business closures led to skyrocketing unemployment, factory closures, and a halt in economic activities, causing panic among investors. Reports of the widening reach of the pandemic coincided with steep daily increases in COVID-19 infections, exacerbating the negative sentiment in the stock markets.

While the COVID-19 pandemic was the primary catalyst for the market crash, other factors contributed to the downturn. Protectionist policies, such as steep tariffs imposed by leaders like Donald Trump, dampened global economic growth. The stage was set for a market correction as early as 2019 when the yield curve on U.S. Treasuries inverted, a historical indicator of an impending recession.

Unlike historical financial crises such as The Great Depression (1929), Crash of 1987 and most recent The Great Recession of 2008 that led to prolonged economic downturns, the resolution of the COVID-19 Pandemic Crash was remarkably swift, thanks to decisive actions by central banks and governments. The Federal Reserve, led by Chair Jerome Powell, implemented measures such as slashing interest rates to zero, unveiling fiscal stimulus packages, and embarking on quantitative easing to inject liquidity into the markets. By November 2020, the stock markets had not only recovered but reached new heights, with the Dow surpassing 30,000 for the first time in history.

The quick recovery demonstrated the resilience of the financial system and the effectiveness of coordinated monetary and fiscal policies in mitigating the economic impact of an unprecedented crisis. The COVID-19 Pandemic Crash 2020 serves as a testament to the interconnectedness of global markets and the importance of swift and coordinated responses in times of crisis.

Related Video Link: Stockmarket v economy: the impact of covid-19

Causes of the COVID-19 Pandemic Crash 2020

-

Global Pandemic

- The emergence and rapid spread of the COVID-19 virus constituted the primary cause of the market crash in 2020. The global pandemic created an unprecedented health crisis, affecting individuals, communities, and entire nations. The highly contagious nature of the virus led to widespread infections, prompting governments worldwide to implement measures aimed at controlling its spread.

- Lockdowns and Travel Restrictions:

- In response to the pandemic, governments implemented strict measures, including lockdowns, quarantine protocols, travel restrictions, and social distancing mandates. These actions were essential for public health but had immediate and severe implications for economic activities.

- Impact on Consumer Behavior:

- The fear of contracting the virus and the implementation of health and safety measures altered consumer behavior. Individuals refrained from engaging in activities that involved physical proximity, leading to reduced spending in sectors such as retail, travel, and hospitality. This shift in consumer behavior contributed to the economic challenges that followed.

-

Economic Shutdowns

- Forced Business Closures:

- Governments worldwide implemented economic shutdowns as a necessary measure to contain the spread of the virus. Many businesses, especially those in the travel, hospitality, and entertainment industries, were forced to close temporarily or operate at significantly reduced capacity.

- Supply Chain Disruptions:

- The economic shutdowns disrupted global supply chains, leading to shortages of goods and services. With production and transportation halted or limited, businesses faced challenges in maintaining normal operations, exacerbating the economic impact of the pandemic.

- Impact on Employment:

- The forced closures and disruptions in economic activities resulted in significant job losses. Millions of workers across various sectors were either furloughed or lost their jobs entirely, leading to a sudden spike in unemployment rates.

- Forced Business Closures:

-

Uncertainty

- Unknown Duration and Severity:

- The uncertainty surrounding the pandemic played a pivotal role in the market crash. Investors and businesses faced challenges in assessing the duration and severity of the crisis. The lack of clarity on when the virus would be contained, when economic activities could resume, and the potential long-term consequences created a high level of uncertainty.

- Market Volatility:

- The uncertainty about the virus’s impact on the global economy led to increased market volatility. Investors, grappling with unpredictable circumstances, engaged in panic selling, exacerbating the downward pressure on stock prices.

- Lack of Visibility into the Future:

- The unprecedented and rapidly evolving nature of the crisis made it difficult for market participants to forecast future economic conditions accurately. The lack of visibility into the future created a sense of unease, contributing to anxiety and panic among investors.

- Unknown Duration and Severity:

Impact and Consequences:

- The combination of the global pandemic, economic shutdowns, and uncertainty created a perfect storm that triggered a significant market crash. The consequences included record-breaking point drops, widespread panic selling, and a sharp contraction in economic activities. The immediate aftermath required swift and decisive policy responses to stabilize financial markets and support economic recovery.

How COVID-19 Pandemic Crash 2020 Happened

-

Widespread Panic Selling

- Investor Fear and Uncertainty:

- The market crash of 2020 was marked by a surge in fear and uncertainty among investors. Faced with the unprecedented challenges posed by the global pandemic, investors grew increasingly concerned about the economic consequences and the potential impact on their investments.

- Key Dates of Panic Selling:

- The panic selling reached a climax on key dates, notably March 9, March 12, and March 16, 2020. During these periods, investors rapidly offloaded their holdings in a frantic attempt to mitigate losses and reduce exposure to the volatile market conditions.

- Record-Breaking Point Drops:

- March 9, 2020, witnessed a historic drop when the Dow fell 2,014 points, representing a 7.79% decline. This trend continued on March 12, with the Dow setting another record by falling 2,352 points, a 9.99% drop. The panic intensified on March 16, as the Dow plummeted nearly 3,000 points, losing 12.9%. These record-breaking point drops reflected the magnitude of the panic-driven sell-off.

- Asset Class Sell-Off:

- The panic selling extended across various asset classes, including stocks, bonds, and commodities. Investors sought to liquidate their positions amid growing uncertainty, contributing to a widespread sell-off that impacted financial markets globally.

- Investor Fear and Uncertainty:

-

Job Losses and Economic Decline

- Lockdown-Induced Economic Standstill:

- The implementation of lockdowns and restrictive measures to contain the spread of the virus brought economic activity to a sudden standstill. Businesses, especially those in sectors directly affected by the lockdowns, faced closures or reduced operations, leading to a decline in revenue and profitability.

- Massive Job Losses:

- Over 20 million jobs were lost during the initial phases of the pandemic as businesses grappled with the economic fallout. Industries such as travel, hospitality, and entertainment were particularly hard-hit, facing unprecedented challenges in the face of travel restrictions and social distancing measures.

- Economic Uncertainty:

- The simultaneous occurrence of widespread job losses, business closures, and economic uncertainty fueled the panic among investors. The lack of clarity on the duration and severity of the economic decline added to the overall anxiety, prompting investors to react by selling off assets in an attempt to minimize financial losses.

- Impact on Corporate Profits:

- The economic decline resulted in a sharp contraction in corporate profits. Companies faced disruptions in supply chains, decreased consumer spending, and operational challenges, contributing to a bleak outlook for corporate earnings. This pessimistic outlook further contributed to the downward pressure on stock prices.

- Lockdown-Induced Economic Standstill:

Related Article: The Role of Fear and Greed in the Stock Market

Consequences and Response:

- The combination of widespread panic selling and economic decline led to a significant market crash. Governments and central banks responded with unprecedented fiscal and monetary measures to stabilize financial markets, support businesses, and address the economic fallout. The events of 2020 highlighted the interconnectedness of financial markets and the need for swift and coordinated responses during times of crisis.

Recovery from the COVID-19 Pandemic Crash 2020

-

Government Interventions

- Unprecedented Fiscal and Monetary Measures:

- Governments worldwide recognized the severity of the economic fallout from the pandemic and responded with unprecedented fiscal and monetary interventions. These measures aimed to provide immediate financial support, stabilize financial markets, and address the economic challenges faced by businesses and households.

- Interest Rate Cuts:

- Central banks, including the U.S. Federal Reserve, implemented interest rate cuts to near-zero levels. The goal was to encourage borrowing, stimulate economic activity, and provide support to financial institutions facing liquidity challenges.

- Fiscal Rescue Package:

- In the United States, Congress approved a historic $2.3 trillion fiscal rescue package to provide a comprehensive response to the economic crisis. The package included direct payments to individuals, expanded unemployment benefits, assistance to businesses, and funding for healthcare initiatives. These measures were designed to inject liquidity into the economy and mitigate the financial hardships caused by the pandemic.

- Stimulus Programs:

- Various stimulus programs were implemented globally to bolster economic activity. These programs included grants, loans, and financial incentives to businesses, with the aim of preventing widespread bankruptcies, maintaining employment levels, and supporting overall economic stability.

- Debt Moratoriums and Relief Measures:

- Some governments also implemented debt moratoriums and relief measures to ease the financial burden on individuals and businesses. These measures provided temporary relief on loan repayments and financial obligations, offering a lifeline during the initial phases of the crisis.

- Unprecedented Fiscal and Monetary Measures:

-

Vaccine Development and Distribution

- Crucial Role in Market Recovery:

- The development and subsequent distribution of COVID-19 vaccines played a pivotal role in restoring confidence and optimism in financial markets. Vaccine breakthroughs provided a tangible solution to the health crisis, contributing to the expectation of a return to normal economic activities.

- Optimism and Confidence Boost:

- As progress was made in vaccine development, investors became more optimistic about the prospect of overcoming the pandemic. The anticipation of widespread vaccination and the eventual control of the virus fueled confidence in a post-pandemic economic recovery.

- Positive Market Sentiment:

- The positive developments in vaccine development contributed to a rebound in market sentiment. Investors, reassured by the potential for an end to the health crisis, began to adjust their portfolios and increase their risk appetite, leading to a recovery in stock prices.

- Anticipation of Economic Normalcy:

- The anticipation of widespread vaccine distribution created expectations for a return to economic normalcy. This optimism influenced investment decisions and contributed to the recovery of industries that were initially hardest hit by the pandemic, such as travel, hospitality, and entertainment.

- Crucial Role in Market Recovery:

Overall Impact and Lessons:

- The combined effect of government interventions and progress in vaccine development facilitated a remarkable recovery from the depths of the 2020 market crash. The events highlighted the importance of coordinated and decisive policy responses during crises and underscored the role of scientific advancements in influencing economic outcomes.

Related Article: Real Estate Investment Trusts (REITs) as a Stock Market Alternative

Lessons from the COVID-19 Pandemic Crash 2020

-

Importance of Adaptability

- Rapidly Evolving Challenges:

- The 2020 market crash underscored the importance of adaptability when facing unforeseen and rapidly evolving challenges. Investors, businesses, and governments were confronted with a health crisis that necessitated swift adjustments to strategies and operations.

- Flexible Investment Strategies:

- Investors had to reassess and adapt their investment strategies to navigate the volatile market conditions. Those who were able to quickly pivot and adjust their portfolios based on changing circumstances were better positioned to weather the storm and capitalize on emerging opportunities.

- Business Strategy Adjustments:

- Businesses faced disruptions to supply chains, shifts in consumer behavior, and unprecedented economic challenges. The ability to adapt business strategies, implement remote work models, and find innovative solutions became crucial for survival and sustainability.

- Government Policy Adaptations:

- Governments had to adapt policies to address the evolving needs of their economies. This included adjusting fiscal stimulus measures, implementing targeted interventions for affected industries, and adapting healthcare policies to respond to the changing dynamics of the pandemic.

- Rapidly Evolving Challenges:

-

Resilience of Markets

- Bounce Back from Adversity:

- Despite the severity of the economic and health crisis, the recovery from the 2020 market crash showcased the resilience of financial markets. Markets demonstrated the ability to bounce back, illustrating their inherent strength and adaptability in the face of unprecedented challenges.

- Investor Confidence Rebuilt:

- The resilience of markets played a crucial role in rebuilding investor confidence. As markets began to recover, investors gained reassurance that the financial system could withstand shocks and resume a path of growth.

- Market Dynamics and Long-Term Outlook:

- The events of 2020 provided valuable insights into market dynamics and the long-term outlook. Understanding the underlying resilience of markets can influence investment decisions and risk assessments, recognizing that markets have the capacity to recover from significant disruptions.

- Bounce Back from Adversity:

-

Need for Rapid Policy Responses

- Proactive Policymaking:

- The swift and comprehensive policy responses by governments and central banks highlighted the need for proactive policymaking during times of crisis. Policymakers recognized the urgency of implementing measures to stabilize financial markets, support businesses, and address the economic fallout.

- Coordination and Decisiveness:

- The ability to coordinate and act decisively in the face of uncertainty was crucial. Governments around the world worked in tandem with central banks to provide fiscal stimulus, monetary support, and relief measures. This coordination helped prevent a more prolonged economic downturn.

- Lessons for Future Crises:

- The need for rapid policy responses serves as a lesson for future crises. Policymakers can draw on the experiences of 2020 to refine strategies for quick and effective interventions, emphasizing the importance of agility in addressing economic challenges.

- Proactive Policymaking:

Related Article: Building Financial Resilience: The Importance of an Emergency Fund

Overall Impact and Forward Outlook:

- The lessons from the 2020 market crash emphasize the dynamic nature of the global economic landscape and the importance of adaptability, resilience, and rapid policy responses in navigating crises and fostering recovery.

Frequently Asked Questions (FAQs)

Q1: What caused the stock market crash in 2020?

A: The stock market crash of 2020 was primarily caused by the onset of the COVID-19 pandemic. The spread of the highly contagious virus led to widespread lockdowns, business closures, and disruptions in labor markets, triggering a rapid and severe decline in global stock market indexes.

Q2: How severe were the market declines during the COVID-19 pandemic crash?

A: The market declines were exceptionally severe, with notable events such as the Dow Jones Industrial Average falling 9.9% on March 12, 2020, setting a new record. In total, the Dow lost 37% of its value in 2020, while the S&P 500 lost 34%.

Q3: Did the COVID-19 pandemic directly cause the stock market crash?

A: Yes, there was a direct correlation between the spread of the COVID-19 virus and the disruption in labor markets, leading to a contraction in GDP. As countries implemented measures to contain the virus, the resultant economic downturn contributed to the stock market crash.

Q4: How did protectionist policies and global events contribute to the crash?

A: Protectionist policies, including steep tariffs imposed by leaders like Donald Trump, dampened global economic growth. Additionally, events like the inversion of the yield curve on U.S. Treasuries in 2019 signaled economic challenges and set the stage for a market correction.

Q5: How quickly did the stock markets recover from the 2020 crash?

A: Unlike historical financial crises, the recovery from the 2020 crash was remarkably swift. The Federal Reserve and governments worldwide implemented decisive measures, such as slashing interest rates, fiscal stimulus packages, and quantitative easing. By November 2020, stock markets had not only recovered but reached new highs.

Q6: Did the COVID-19 Pandemic Crash lead to a prolonged economic downturn?

A: No, unlike some historical financial crises, the COVID-19 Pandemic Crash did not lead to a prolonged economic downturn. The combination of decisive monetary and fiscal policies contributed to a rapid recovery, and by November 2020, stock markets had surpassed pre-crash levels.

Q7: Why did the market rebound despite economic challenges?

A: Government interventions, including fiscal stimulus packages and monetary policies, played a crucial role in stabilizing financial markets. Additionally, progress in COVID-19 vaccine development and distribution contributed to optimism, leading to a market rebound.

Q8: What role did vaccine development play in the recovery?

A: Progress in COVID-19 vaccine development and distribution boosted investor confidence. The anticipation of a return to economic normalcy and the control of the virus played a significant role in the rebound of market sentiment.

Q9: How can investors prepare for future market uncertainties?

A: Investors can prepare for uncertainties by diversifying their portfolios, staying informed about economic conditions, and having a well-defined investment strategy. Regularly reviewing and adjusting investment plans in response to changing circumstances is crucial.