Mobileye Global Inc. (Nasdaq: MBLY) is a prominent player in the automotive industry, renowned for its advanced driver-assistance systems (ADAS) and autonomous driving technologies. Founded in 1999, the Israeli company (Parent Company: Intel, since 2017) leverages computer vision, machine learning, and proprietary chips to develop solutions that enhance road safety and pave the way for self-driving cars. Mobileye’s innovative solutions have garnered significant attention in the automotive industry.

It recently released its fourth-quarter and full-year 2023 financial results along with business highlights. Let’s delve into a detailed fundamental analysis of the company to understand its performance, growth prospects, and financial health.

Financial Performance:

- Revenue: Grew 13% year-over-year to $637 million in Q4 2023, meeting expectations.

- Profitability: Operating and Adjusted Operating Income improved significantly, despite a decline in Adjusted Gross Margin due to higher EyeQ SoC costs.

- Earnings: Diluted EPS (GAAP) was $0.08 and Adjusted Diluted EPS (Non-GAAP) was $0.28 in Q4 2023.

- Cash Flow: Generated strong net cash from operating activities of $394 million in 2023, boasting a healthy balance sheet with $1.2 billion in cash and no debt.

- Guidance: Reaffirmed the preliminary 2024 outlook with revenue growth expected to be impacted by customer inventory build-up.

Business Highlights:

- Business Development: Secured design wins projected to generate $7.4 billion of future revenue, demonstrating continued strong demand for its technology.

- ADAS Business: Launched systems into approximately 300 vehicle models in 2023, expanding its market reach.

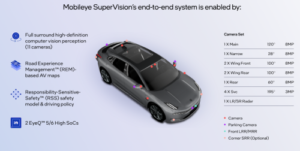

- SuperVision™: Shipped over 100,000 units, secured new business awards, and expanded its vehicle model pipeline to 30.

- Chauffeur™: Achieved first production program awards and secured 600,000 units of future volume based on current design wins.

- ESG: Committed to building a robust ESG program, aiming to publish its first Corporate Sustainability Report in 2024.

Strengths:

- Strong Financial Position:

- Ample Cash Reserves ($1.2 billion): Provides a financial cushion for investments, acquisitions, and weathering economic downturns.

- No Debt: Offers financial flexibility and avoids interest expenses, improving profitability.

- Solid Track Record of Innovation:

- Leader in ADAS and Autonomous Driving: Positions Mobileye to capitalize on future market growth.

- Strong R&D Investment: Ensures continuous innovation and differentiation in a rapidly evolving field.

- Growing Customer Base:

- Expanding Partnerships with Major Automakers: Secures market share and recurring revenue streams.

- Diversified Customer Portfolio: Reduces dependence on any single customer and mitigates risk.

- Multiple Revenue Streams:

- ADAS, SuperVision, and Chauffeur: Offers multiple avenues for growth and reduces reliance on any single product.

- Recurring Revenue from Software and Services: Provides predictable income and strengthens financial stability.

Weaknesses:

- Short-Term Revenue Impact:

- Customer Inventory Build-up: Delays revenue recognition and impacts 2024 growth projections.

- Uncertain Duration: Creates ambiguity about the long-term impact on revenue.

- Profitability Challenges:

- Balancing Cost Increases and Pricing: Higher EyeQ SoC costs pressure margins, requiring strategic pricing adjustments.

- Need for Operational Efficiency: Optimizing costs and expenses is crucial for maintaining profitability.

- Competition:

- Stiff Competition from Established Players and New Entrants: Requires continuous innovation and differentiation to maintain market share.

- Competitive Pricing Pressures: May limit pricing power and impact profitability.

Opportunities:

- Growing ADAS Market:

- Increasing Demand for Safety Features: Drives market expansion and creates new revenue opportunities.

- ADAS as a Stepping Stone to Autonomous Driving: Positions Mobileye well for future market leadership.

- Expansion of SuperVision and Chauffeur:

- Early Stage Technologies with High Growth Potential: Offer significant revenue upside as they mature and gain wider adoption.

- First-Mover Advantage: Positions Mobileye to capture market share and establish brand leadership.

- Partnerships and Acquisitions:

- Collaboration with Complementary Companies: Accelerates development and expands market reach.

- Strategic Acquisitions: Provides access to new technologies, talent, and customer segments.

Threats:

- Regulatory Hurdles:

- Uncertain Regulatory Landscape for Autonomous Vehicles: Delays commercialization and creates compliance challenges.

- Varying Regulations by Region: Requires navigating complex legal frameworks and adapting technologies accordingly.

- Technological Advancements:

- Rapidly Evolving Technology: Demands continuous innovation to stay ahead of the competition.

- High R&D Costs: Maintaining technological leadership requires significant investments.

- Economic Downturns:

- Reduced Consumer Spending: Impacts auto sales and potentially dampens demand for ADAS and autonomous driving technologies.

- Investor Risk Aversion: May limit access to capital for growth and expansion.

Overall, Mobileye remains a well-positioned leader in the autonomous driving space. While facing short-term challenges, its strong fundamentals, innovative technology, and diverse revenue streams offer promising long-term prospects.

Further Exploration

- Q4 and Full Year 2023 results and business overview

- Investors Relations: https://ir.mobileye.com/

- CES 2024 Press Conference: https://ir.mobileye.com/events/event-details/ces-2024-press-conference-mobileye-now-next-beyond-prof-amnon-shashua

Disclaimer: This analysis is based on publicly available information and should not be considered financial advice. Please consult with a financial professional before making any investment decisions.

You might be interested in:

2 Comments