Introduction

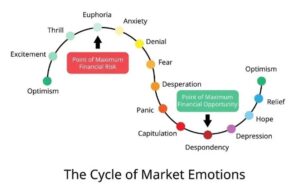

Fear and greed play pivotal roles in the stock market, influencing investor behavior and market dynamics. Fear of losses often leads to panic selling, triggering market downturns, while economic uncertainties can create volatility as investors become apprehensive about the future. On the other hand, greed fuels the desire for profits, leading to speculative trading and stock overvaluation. Greedy investors, driven by the fear of missing out, can inflate stock prices, creating bubbles that eventually burst. These emotional factors contribute to market fluctuations and underscore the importance of rational, long-term decision-making amid the volatile interplay of fear and greed.

What Is the Fear and Greed Index?

The Fear and Greed Index is a popular metric (published by CNN Money) used by investors to gauge market sentiment. It measures the emotions and attitudes of investors towards the stock market, providing insights into whether investors are feeling fearful or greedy. The index is based on various indicators and data points, including stock price movements, market volatility, trading volume, and surveys of market participants.

The Fear and Greed Index typically ranges from 0 to 100, with lower values indicating extreme fear and higher values indicating extreme greed among investors. Here’s a general breakdown of the index values:

- 0-25: Extreme Fear: Investors are extremely fearful, which might signal a good buying opportunity because stocks could be undervalued.

- 26-50: Fear: Investors are fearful, indicating a cautious market sentiment.

- 51-75: Greed: Investors are greedy, suggesting that the market might be overbought, and a correction could be on the horizon.

- 76-100: Extreme Greed: Investors are extremely greedy, which might signal a good selling opportunity because stocks could be overvalued.

Investors use the Fear and Greed Index as a contrarian indicator. When the index shows extreme fear, it might be a good time to consider buying stocks because market sentiment is overly negative. Conversely, when the index shows extreme greed, it might be a sign to be cautious and consider selling, as the market could be overvalued.

CNN publishes its Fear and Greed Index every day. It keeps a weekly, monthly and annual index as well.

How is Fear and Greed Index Calculated?

The Fear and Greed Index is calculated using a combination of different indicators and data points that reflect investor sentiment and market behavior. While the exact formula and the specific indicators used in different versions of the index may vary, the following are some common components that are typically considered:

1. Stock Price Momentum: Stock price momentum refers to the trend and direction in which stock prices are moving. When the prices of major market indices like the S&P 500 are rising over a specific period, it often indicates that investors are optimistic about the market’s future performance. This optimism can be associated with greed as investors are confident in the market’s upward momentum. Conversely, falling prices might indicate fear among investors, as declining values can lead to concerns about economic stability and potential losses on investments.

2. Market Volatility: Market volatility, measured by indices like the CBOE Volatility Index (VIX), reflects the degree of variation in the price of a financial instrument within a certain period. Higher volatility suggests larger price fluctuations, indicating uncertainty and fear among investors. Investors are unsure about the market’s future direction, leading to a cautious approach and, in some cases, panic selling.

3. Put and Call Options: Put options give investors the right to sell a security at a specified price within a specific timeframe, while call options give the right to buy. The ratio of put options to call options, known as the put/call ratio, is a sentiment indicator. A high put/call ratio implies that more investors are buying put options (betting on a price decline) compared to call options (betting on a price increase). This heightened demand for put options suggests fear among investors, as they are trying to hedge against potential losses in a declining market.

4. Market Breadth: Market breadth measures the overall health of the market by comparing the number of advancing stocks (stocks with price increases) to declining stocks (stocks with price decreases). A declining market breadth, where more stocks are falling than rising, indicates weakness and can be a sign of fear among investors. It suggests that a smaller number of stocks are driving the market down, causing concerns about broader market stability.

5. Safe Haven Demand: During times of fear and uncertainty, investors often seek safety in assets considered to be safe havens, such as government bonds and gold. The demand for these assets increases because they are perceived as stable and less risky compared to stocks. This shift of funds into safe havens reflects fear among investors about the overall market conditions and economic outlook.

6. Junk Bond Demand: Junk bonds are high-yield, high-risk bonds issued by companies with lower credit ratings. When there is a higher demand for junk bonds compared to safer investment-grade bonds, it suggests that investors are willing to take on more risk in search of higher returns. This increased appetite for risk can indicate greed among investors, as they are chasing potentially higher profits despite the higher level of risk associated with junk bonds.

7. Stock Price Strength: Monitoring the number of stocks hitting 52-week highs versus 52-week lows provides insights into market strength or weakness. More stocks hitting new highs indicate that a significant number of companies are performing well, suggesting investor confidence and greed. On the other hand, more stocks hitting new lows might suggest fear, as investors are concerned about the poor performance of many companies, leading to a weaker overall market sentiment.

Impact on the Stock Market

1. Volatility: Fear and greed are significant drivers of market volatility. When investors experience fear, they tend to sell off their investments rapidly, causing prices to drop quickly. Conversely, greed can lead to frenzied buying, inflating prices. These rapid and unpredictable price movements characterize a volatile market, making it challenging for investors to anticipate and react to changes effectively.

2. Market Swings: The interplay of fear and greed results in sudden and sharp market swings. When fear grips the market, investors hastily sell off stocks, leading to a rapid decline in prices. Conversely, bursts of greed can cause investors to buy en masse, creating artificial demand and driving prices higher swiftly. These abrupt shifts impact investors’ portfolios, potentially causing significant gains or losses in a short period. Market swings can create uncertainty and make it difficult for investors to make well-informed decisions.

3. Herd Mentality: Fear and greed often trigger herd mentality in the stock market. When investors observe others panic selling due to fear or aggressively buying due to greed, they tend to follow the crowd. This herd behavior amplifies market movements, intensifying both upward and downward trends. Herd mentality can lead to market bubbles, where prices are driven far beyond the intrinsic value of assets. When the bubble inevitably bursts, it can result in substantial market corrections and financial losses for those caught up in the herd.

4. Regulation and Intervention: To mitigate the adverse effects of fear and greed, regulatory bodies and market authorities often intervene in the stock market. Regulations are in place to maintain market integrity, ensuring fair practices and preventing manipulation. In times of extreme volatility caused by fear and greed, regulators may step in to stabilize prices and restore investor confidence. Interventions can include measures like circuit breakers (temporary halts in trading) to prevent excessive price swings, stricter trading rules, or monetary policies to calm the market. These interventions aim to create a more stable environment, allowing investors to make decisions based on fundamentals rather than being solely driven by emotional reactions to fear and greed.

Drawbacks of using the Fear and Greed Index

While the Fear and Greed Index can provide valuable insights into market sentiment, it also has several drawbacks that investors should be aware of:

- Simplistic Nature: The Fear and Greed Index is a simplified measure that combines multiple indicators into a single value. It doesn’t provide a detailed analysis of each individual indicator or the underlying factors affecting market sentiment.

- Lack of Context: The index might not provide enough context about why investors are feeling fearful or greedy. It doesn’t explain the specific reasons behind market sentiment, making it challenging to make well-informed investment decisions solely based on the index.

- Subjectivity: The selection and weighting of indicators can vary between different versions of the Fear and Greed Index. Different publishers may prioritize different indicators, leading to potential subjectivity and bias in the index calculation.

- Market Manipulation: In some cases, traders and investors can manipulate certain indicators to influence the Fear and Greed Index. This manipulation can distort the true market sentiment reflected by the index.

- Limited Historical Data: Some versions of the Fear and Greed Index have a relatively short history, making it difficult to assess its long-term predictive power. Investors should be cautious when relying on historical data from these indices to make future predictions.

- Market Complexity: Financial markets are influenced by a wide range of factors, including economic indicators, geopolitical events, and monetary policy decisions. The Fear and Greed Index may not capture all these complexities, leading to an oversimplified view of market sentiment.

- Contrarian Indicator Risk: While the Fear and Greed Index is often used as a contrarian indicator (buying when there’s fear and selling when there’s greed), blindly following this strategy can be risky. Market conditions can change rapidly, and what appears to be fear or greed today might not persist in the future.

- No Causation: The Fear and Greed Index shows correlation with market movements, but it doesn’t imply causation. Just because the index shows extreme fear doesn’t guarantee that the market will rebound, or vice versa.

Given these limitations, it’s essential for investors to use the Fear and Greed Index as one of many tools in their decision-making process. It should be combined with thorough research, analysis of fundamental and technical factors, and consideration of one’s own risk tolerance and investment goals.

Using the Fear and Greed Index in Investment Strategies

While the Fear and Greed Index has its limitations, it can still be a valuable tool in the context of a broader investment strategy. Here are a few ways in which investors might consider using the Fear and Greed Index:

- Contrarian Investing: One common approach is to use the Fear and Greed Index as a contrarian indicator. When the index indicates extreme fear (low values), it might suggest that investors are overly pessimistic, potentially presenting a buying opportunity. Conversely, when the index indicates extreme greed (high values), it might indicate an overbought market and a potential selling opportunity.

- Confirmation of Trends: Investors can use the Fear and Greed Index to confirm trends identified through other analyses. For example, if technical analysis suggests a bullish trend and the Fear and Greed Index is also showing investor greed, it might provide additional confidence in the strength of the trend.

- Market Timing: While market timing is notoriously difficult, some investors use the Fear and Greed Index to help with timing decisions. For instance, if the index shows a significant shift from greed to fear, it might indicate a potential market downturn, prompting investors to consider defensive moves in their portfolios.

- Diversification Decisions: Extreme readings on the Fear and Greed Index could influence decisions regarding portfolio diversification. In times of extreme greed, investors might consider rebalancing their portfolios to reduce exposure to potentially overvalued assets. Conversely, in times of extreme fear, investors might seek to diversify into assets that are historically considered safe havens.

- Long-Term Investment Perspective: While the Fear and Greed Index is often used for short-term or intermediate-term trading strategies, long-term investors might also find it useful. For instance, extreme fear in the market might present long-term investors with an opportunity to accumulate fundamentally strong assets at a discount.

- Risk Management: Investors can use the Fear and Greed Index as a risk management tool. For example, if the index shows extreme greed and the investor’s portfolio is heavily weighted towards equities, it might prompt a reassessment of risk exposure and potential adjustments to the portfolio allocation.

- Educational Tool: For novice investors, the Fear and Greed Index can serve as an educational tool, helping them understand the emotional aspect of investing and how market sentiment can impact stock prices. It can encourage a more cautious and rational approach to decision-making.

It’s crucial, however, to emphasize that the Fear and Greed Index should not be the sole basis for investment decisions. It should be used in conjunction with thorough fundamental analysis, technical analysis, and consideration of individual financial goals and risk tolerance. Additionally, investors should be aware of the index’s limitations and exercise caution when interpreting its signals.

Top 7 Fears of Traders

Traders often face various fears that can impact their decision-making and trading performance. Here are seven common fears among traders and strategies to overcome them:

- Fear of Loss (Loss Aversion): Many traders fear losing money, which can lead to overly conservative or impulsive trading decisions. To overcome this fear:

- Set clear stop-loss and take-profit levels before entering a trade.

- Diversify your portfolio to reduce risk.

- Use proper position sizing and risk management techniques to limit potential losses.

- Fear of Missing Out (FOMO): Traders may fear missing out on profitable opportunities, causing them to chase trends or enter trades hastily. To overcome FOMO:

- Stick to your trading plan and strategy, and don’t deviate from it due to impulsive decisions.

- Avoid trading based on emotions or social media hype.

- Focus on the quality of your trades rather than the quantity.

- Fear of Uncertainty: The uncertainty of financial markets can cause anxiety and hesitation. To overcome the fear of uncertainty:

- Educate yourself about the markets and trading strategies to gain confidence.

- Use technical and fundamental analysis to make informed decisions.

- Accept that uncertainty is a part of trading and have a risk management plan in place.

- Fear of Being Wrong (Ego): Some traders fear making mistakes or being proven wrong, which can lead to stubbornness and refusal to exit losing positions. To overcome the ego-driven fear:

- Acknowledge that everyone makes mistakes in trading.

- Embrace humility and be willing to admit when a trade is not working.

- Focus on the process and continuous improvement, rather than individual trade outcomes.

- Fear of Volatility: High market volatility can be intimidating and lead to fear-driven trading. To overcome the fear of volatility:

- Practice with a demo account to get comfortable with volatile conditions.

- Develop trading strategies that adapt to different market conditions, including high volatility.

- Be patient and avoid trading during excessively chaotic times.

- Fear of Overtrading: Traders may fear missing opportunities, causing them to overtrade and increase risk. To overcome this fear:

- Set daily or weekly trading limits to prevent overtrading.

- Focus on quality setups and avoid making impulsive trades.

- Maintain discipline and stick to your trading plan.

- Fear of the Unknown: The unknown factors in trading, such as unexpected news events, can be unsettling. To overcome the fear of the unknown:

- Stay informed about economic calendars and news events that could impact the markets.

- Consider using limit orders and conditional orders to manage trades during news releases.

- Accept that unexpected events are part of trading and be prepared to adapt your strategy as needed.

Remember that overcoming these fears in trading is an ongoing process, and it often requires practice, discipline, and psychological resilience. Developing a well-defined trading plan, proper risk management, and a commitment to continuous learning can help traders mitigate these fears and make more rational and informed decisions. Additionally, seeking support from mentors or therapists specializing in trading psychology can be beneficial.

Related articles:

Dollar-Cost Averaging: A Strategy for Volatile Markets

21 Different Types of Investment Accounts

30 stocks of Dow Jones: History, Present and Facts

Fear and Greed Index FAQs:

What is the CNN Business Fear & Greed Index?

The Fear & Greed Index is a way to gauge stock market movements and whether stocks are fairly priced. The theory is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

How is Fear & Greed Calculated?

The Fear & Greed Index is a compilation of seven different indicators that measure some aspect of stock market behavior. They are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand. The index tracks how much these individual indicators deviate from their averages compared to how much they normally diverge. The index gives each indicator equal weighting in calculating a score from 0 to 100, with 100 representing maximum greediness and 0 signaling maximum fear.

How often is the Fear & Greed Index calculated?

Every component and the Index are calculated as soon as new data becomes available.

How to use Fear & Greed Index?

The Fear & Greed Index is used to gauge the mood of the market. Many investors are emotional and reactionary, and fear and greed sentiment indicators can alert investors to their own emotions and biases that can influence their decisions. When combined with fundamentals and other analytical tools, the Index can be a helpful way to assess market sentiment.

1 Comment