The financial crisis of 2007–2008 was a complex and far-reaching event that unfolded over several years, ultimately leading to a profound global economic downturn known as The Great Recession. The crisis had its roots in the preceding years, marked by a surge in cheap credit and lax lending standards that fueled a housing bubble in the United States and beyond.

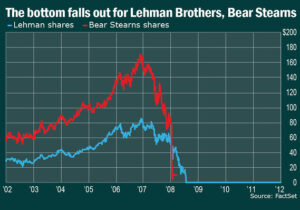

The signs of trouble began to emerge in the summer of 2007. Bear Stearns hedge funds collapsed, BNP Paribas warned of potential fund withdrawals, and Northern Rock sought emergency funding from the Bank of England. However, few foresaw the magnitude of the impending crisis.

The crisis developed gradually, with home prices starting to fall in early 2006. Subprime lenders began filing for bankruptcy in early 2007, and by June of that year, two significant hedge funds collapsed due to their exposure to subprime loans. In August 2007, the global lending system experienced a panic as losses from subprime loan investments triggered a freeze in the interbank market.

One of the pivotal moments occurred in September 2008 when Lehman Brothers, one of the major U.S. investment banks, collapsed in the largest bankruptcy in U.S. history. The fallout from Lehman Brothers’ collapse sent shockwaves through the financial system, leading to a severe economic downturn. Financial institutions were left holding trillions of dollars in near-worthless investments in subprime mortgages, contributing to the global financial meltdown.

The crisis had its roots in the combination of rock-bottom interest rates and loose lending standards that fueled the housing price bubble. The Federal Reserve, in response to various economic challenges, lowered interest rates significantly, leading to an upward spiral in home prices. Even subprime borrowers, those with poor credit, were able to access mortgages.

Banks sold these loans to Wall Street, where they were bundled into financial instruments like mortgage-backed securities and collateralized debt obligations (CDOs). The Securities and Exchange Commission’s relaxation of net capital requirements for major investment banks further fueled risk-taking behavior.

As interest rates started to rise and homeownership reached saturation, the bubble burst. Home prices began to fall in early 2006, causing distress for homeowners and triggering a chain reaction of financial challenges. Subprime lenders went bankrupt, leading to a series of failures in the financial sector.

By August 2007, the panic had frozen the global lending system, and in September 2008, Lehman Brothers’ collapse marked a critical turning point. The crisis prompted a series of government interventions, including the Troubled Asset Relief Program (TARP), aimed at stabilizing the financial system and restoring confidence.

The aftermath of the crisis included widespread public indignation and efforts to reform financial regulations. The Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 was a comprehensive attempt to prevent a recurrence of such a crisis, implementing measures to restrict risky activities by major banks and enhance consumer protection.

While the economy eventually recovered, the 2007–2008 financial crisis left lasting scars, with millions losing their jobs, savings, and homes. The crisis highlighted the interconnectedness of global financial markets and the need for vigilant oversight to prevent excessive risk-taking and protect the stability of the financial system.

Related Article: The Real Estate Dilemma: Should You Buy or Rent?

Causes of the Global Financial Crisis (2007-2008)

1. Subprime Mortgage Crisis

-

Collapse of the U.S. Housing Market

- The crisis had its roots in the collapse of the U.S. housing market. A housing bubble had formed, fueled by an increase in housing prices that was unsustainable. As home prices soared, lenders extended subprime mortgages—high-risk loans—to borrowers with poor credit histories who were often unable to meet conventional lending standards.

-

Proliferation of Subprime Mortgages

- The proliferation of subprime mortgages meant that a significant portion of the population was exposed to high-risk loans. As long as home prices continued to rise, borrowers could refinance or sell their homes to cover the debt. However, when the housing bubble burst, many borrowers found themselves underwater, owing more on their mortgages than the value of their homes.

-

Securitization and Risk Spreading

- Financial institutions bundled these subprime mortgages into complex securities, known as mortgage-backed securities (MBS). These MBS were then sold to investors, including banks and other financial institutions. The idea was to spread the risk associated with these high-risk mortgages throughout the financial system.

-

Impact of Housing Market Collapse

- When the housing market collapsed, the value of MBS plummeted, causing substantial losses to investors. Financial institutions faced the double blow of declining asset values and increasing numbers of mortgage defaults.

2. Complex Financial Instruments

-

Mortgage-Backed Securities (MBS) and Collateralized Debt Obligations (CDOs)

- Complex financial instruments played a crucial role in the crisis. Mortgage-backed securities (MBS) were bundles of mortgages sold to investors, while collateralized debt obligations (CDOs) were complex securities backed by a pool of bonds, loans, and other assets.

-

Lack of Transparency

- The complexity of these financial instruments made them difficult to understand and evaluate. The lack of transparency in how these securities were structured and the risks associated with them created a situation where investors were exposed to risks they did not fully comprehend.

-

Rating Agencies’ Role

- Rating agencies assigned high credit ratings to many of these complex instruments, providing a false sense of security to investors. The ratings did not accurately reflect the underlying risks, contributing to a mispricing of assets and a misunderstanding of the potential consequences.

3. Inadequate Risk Management

-

Underestimation of Risks

- Financial institutions engaged in the creation and trading of complex securities failed in their risk management practices. Many institutions underestimated the risks associated with these securities, relying on flawed assumptions about housing prices and the stability of the financial system.

-

Lack of Stress Testing

- Inadequate stress testing and risk assessment practices meant that financial institutions were ill-prepared for the impact of a widespread decline in housing prices. When the housing bubble burst, the adverse effects on financial institutions were more severe than anticipated.

-

Excessive Leverage

- Many financial institutions operated with high levels of leverage, amplifying the impact of losses on their capital. Excessive leverage meant that even a relatively small decline in the value of assets could lead to severe financial distress.

Legacy and Impact:

- The causes of the Global Financial Crisis highlighted systemic weaknesses in the financial system, including the reliance on high-risk lending, the opacity of complex financial instruments, and shortcomings in risk management practices. The crisis prompted a reevaluation of financial regulations and risk management strategies to prevent a recurrence of such widespread financial turmoil.

Related Video Link: Here’s What Caused the Great Recession

How the Global Financial Crisis (2007-2008) Happened

1. Bursting of the Housing Bubble

- Sharp Decline in Mortgage-Backed Securities (MBS) Values

- The crisis was set in motion by the bursting of the U.S. housing bubble. As home prices fell and the value of mortgage-backed securities (MBS) tied to these mortgages declined, financial institutions that held these securities faced substantial losses. The MBS, which were once considered safe investments, now carried significantly reduced values.

2. Widespread Bank Failures

-

Insolvency and Banking System Stress

- The decline in MBS values resulted in massive losses for financial institutions that were highly exposed to these securities. Many institutions found themselves holding assets worth far less than their recorded values, leading to insolvency concerns.

- As financial institutions faced liquidity problems and a lack of capital, a series of bank failures unfolded. Some institutions were unable to meet their obligations, while others faced a loss of confidence from depositors and creditors.

-

Domino Effect on the Banking System

- The insolvency of major financial institutions triggered a domino effect within the banking system. Interbank lending, a critical component of the financial system, seized up as banks became wary of each other’s solvency. The loss of confidence in one institution could quickly spread to others, creating a cascading effect.

-

Government Interventions and Bailouts

- To prevent a complete collapse of the financial system, governments intervened with massive bailout packages. Troubled financial institutions were provided with capital injections and guarantees to stabilize their balance sheets and restore confidence in the banking sector.

3. Stock Market Declines

-

Erosion of Investor Confidence

- As news of bank failures and the extent of financial institutions’ exposure to toxic assets became apparent, investor confidence eroded. The uncertainty surrounding the financial sector and concerns about the broader economic impact led to a mass sell-off in stock markets.

-

Significant Declines in Stock Prices

- Stock markets experienced significant declines as investors rushed to liquidate their holdings to minimize losses. The selling pressure was exacerbated by automated trading algorithms and a general sense of panic in the financial markets.

-

Impact on Pension Funds and Investors

- The decline in stock prices had a severe impact on pension funds, institutional investors, and individual investors. Retirement savings and investment portfolios suffered substantial losses, exacerbating the overall economic impact on households and businesses.

4. Global Economic Downturn

-

Spillover into Broader Economy

- The financial turmoil did not remain confined to the banking sector and stock markets; it spilled over into the broader economy. The freeze in credit markets impaired the functioning of businesses and households, restricting access to loans and capital.

-

Global Recession

- The combination of bank failures, stock market declines, and the credit crunch contributed to a global economic downturn. Businesses faced difficulties in securing financing for operations and expansion, leading to widespread layoffs, closures, and a contraction in economic activity.

-

Rising Unemployment and Fiscal Challenges

- Unemployment rates rose as businesses struggled to stay afloat in the harsh economic conditions. Governments faced fiscal challenges as they grappled with the need for stimulus measures and increased social spending to counteract the economic downturn.

Legacy and Impact:

- The Global Financial Crisis left a lasting impact on the financial system and the global economy. The sequence of events highlighted vulnerabilities in the financial sector, prompting a reevaluation of regulatory frameworks, risk management practices, and the interconnectedness of financial institutions. The crisis also emphasized the need for international cooperation to address systemic risks and prevent a recurrence of such widespread financial turmoil.

Related Article: Warren Buffet’s Investment Strategies

Recovery from the Global Financial Crisis (2007-2008)

1. Bailouts

-

Financial Support to Troubled Banks

- Governments worldwide recognized the critical importance of stabilizing the financial sector. Troubled banks, particularly those deemed “too big to fail” due to their systemic significance, were provided with financial support and bailouts. This involved injecting capital into struggling institutions to strengthen their balance sheets and prevent further insolvencies.

-

Preventing Systemic Collapse

- The primary goal of the bailouts was to prevent a systemic collapse of the financial system, which could have had far-reaching and devastating consequences for the broader economy. By shoring up the financial institutions at the center of the crisis, governments aimed to restore confidence and stability in the banking sector.

2. Stimulus Packages

-

Boosting Economic Activity and Employment

- Governments implemented fiscal stimulus packages to counteract the economic downturn. These packages included a combination of tax cuts, increased government spending on infrastructure projects, and targeted measures to stimulate consumer spending.

-

Addressing Contractionary Pressures

- The fiscal stimulus was designed to address contractionary pressures in the economy, as businesses faced reduced demand and households cut back on spending. By injecting funds into the economy, governments sought to spur economic activity, prevent further layoffs, and support businesses.

3. Monetary Policy

-

Expansionary Monetary Policies

- Central banks enacted expansionary monetary policies to complement fiscal measures. This included lowering interest rates to historically low levels to make borrowing more attractive for businesses and consumers. Additionally, central banks engaged in quantitative easing, a policy of purchasing financial assets to inject liquidity into the financial system.

-

Encouraging Lending and Investment

- The goal of these monetary measures was to encourage lending and investment, supporting economic growth. By lowering interest rates and increasing the availability of credit, central banks aimed to ease financial conditions and promote spending and investment.

Challenges and Variability in Recovery

-

Slow and Varied Recovery

- The recovery from the Global Financial Crisis was slow and varied by region. Some economies rebounded more quickly than others, depending on factors such as the severity of the crisis, the effectiveness of policy responses, and the structure of the economy.

-

Persistent Challenges

- Despite concerted efforts to stabilize the financial system and stimulate economic growth, persistent challenges hindered progress. High unemployment rates, a consequence of the recession, continued to pose a significant social and economic challenge. Governments faced the dilemma of balancing the need for fiscal discipline with the imperative of supporting job creation and economic recovery.

-

Government Debt Concerns

- The fiscal stimulus measures and bailouts led to increased government debt levels in many countries. This raised concerns about the sustainability of public finances and sparked debates about the appropriate balance between short-term stimulus and long-term fiscal responsibility.

Legacy and Impact:

- The recovery efforts marked a pivotal period in economic policymaking. Governments and central banks demonstrated a willingness to take unconventional measures to prevent a deeper crisis. However, the challenges of addressing long-term structural issues, such as unemployment and government debt, persisted and influenced subsequent economic policies. The experience of the Global Financial Crisis shaped discussions on the role of government intervention in times of economic turmoil and the need for a coordinated and comprehensive approach to crisis management.

Related Article: Dot-Com Bubble Burst (2000-2002)

Lessons from the Global Financial Crisis (2007-2008)

1. Improved Risk Management

-

Recognition of the Need for Accuracy

- The crisis underscored the critical need for financial institutions to enhance their risk management practices. The reliance on flawed risk assessments and the failure to conduct thorough stress testing became evident during the crisis. Institutions recognized the importance of accurately assessing risks to avoid underestimating potential vulnerabilities.

-

Stress Testing and Scenario Analysis

- Improved risk management practices involved the implementation of more robust stress testing and scenario analysis. Financial institutions began to incorporate a broader range of potential economic conditions and shocks into their risk models. This allowed them to better understand and prepare for adverse scenarios.

-

Focus on Liquidity Risk

- Liquidity risk, which played a significant role in the crisis, became a particular focus. Financial institutions realized the importance of maintaining adequate liquidity buffers to withstand periods of market stress. This shift in perspective aimed to prevent a repeat of the liquidity shortages that contributed to the severity of the crisis.

2. Increased Financial Regulation

-

Recognition of Regulatory Inadequacies

- The inadequacies in financial regulation became apparent as the crisis unfolded. Regulatory frameworks were not sufficiently equipped to prevent excessive risk-taking, ensure transparency, and safeguard the stability of financial institutions. This realization prompted a reevaluation of the regulatory landscape.

-

Calls for Enhanced Oversight

- Lessons learned from the crisis led to calls for enhanced regulatory oversight. Policymakers sought to strengthen regulatory frameworks to address gaps and shortcomings. This included measures to improve transparency, risk disclosure, and the monitoring of systemic risks within the financial system.

-

Basel III and Regulatory Reforms

- Internationally, the Basel III framework emerged as a response to the crisis, introducing more stringent capital requirements and liquidity standards for banks. Additionally, regulatory reforms aimed to address issues such as the valuation of complex financial instruments and the oversight of credit rating agencies.

3. Interconnectedness of Global Financial Markets

-

Recognition of Interconnected Nature

- The crisis underscored the interconnected and interdependent nature of global financial markets. Financial distress originating in one part of the world could quickly spread to others, leading to a contagion effect. This realization emphasized the need for a more holistic and globally coordinated approach to financial stability.

-

Importance of International Cooperation

- Policymakers recognized the importance of international cooperation and coordination in addressing financial challenges. The globalized nature of finance meant that actions taken by one country could have far-reaching implications for others. This understanding influenced efforts to establish mechanisms for collaboration among central banks, financial authorities, and regulatory bodies worldwide.

-

G20 and Global Policy Coordination

- The G20 became a platform for global policy coordination in the aftermath of the crisis. Leaders from major economies engaged in discussions to align policies, share information, and implement measures to stabilize the global financial system. This collaborative approach aimed to minimize the risk of future crises originating from interconnected global markets.

Legacy and Impact:

- The lessons learned from the Global Financial Crisis had a lasting impact on financial institutions, regulatory bodies, and policymakers. The reforms and changes in risk management practices contributed to a more resilient financial system, with ongoing discussions and adjustments to adapt to evolving economic conditions. The interconnectedness of global financial markets remains a focal point for policymakers, emphasizing the need for continued international cooperation to address systemic risks.

Related Article: Understanding Option Trading: For Beginners

Frequently Asked Questions (FAQs)

Q1. What were the main causes of the Global Financial Crisis?

A. The crisis had multiple causes, but key factors include the collapse of the U.S. housing market due to a housing bubble and subprime mortgage crisis. The proliferation of high-risk subprime mortgages, securitization of these mortgages into complex financial instruments, and inadequate risk management practices in financial institutions played significant roles.

Q2. How did the housing bubble contribute to the crisis?

A. The housing bubble was fueled by rock-bottom interest rates and lax lending standards. As home prices soared, subprime mortgages were extended to borrowers with poor credit. When the bubble burst, home values plummeted, leading to widespread mortgage defaults and financial instability.

Q3. What role did complex financial instruments like MBS and CDOs play in the crisis?

A. Mortgage-backed securities (MBS) and collateralized debt obligations (CDOs) were financial instruments created from bundled mortgages. The complexity and lack of transparency in these instruments contributed to a misunderstanding of risks. Rating agencies assigned high ratings, creating a false sense of security, further exacerbating the crisis.

Q4. How did Lehman Brothers’ collapse impact the financial system?

A. Lehman Brothers’ collapse in September 2008 marked a critical turning point. The bankruptcy sent shockwaves through the financial system, causing a freeze in the interbank market and triggering a severe economic downturn. It exposed the fragility of financial institutions and led to a series of government interventions to stabilize the system.

Q5. What were the government interventions in response to the crisis?

A. Governments worldwide implemented measures such as bailouts and stimulus packages to stabilize the financial system. Troubled banks received financial support to prevent insolvency, and fiscal stimulus packages aimed to boost economic activity. Central banks also enacted expansionary monetary policies, including lowering interest rates and engaging in quantitative easing.

Q6. How did the Global Financial Crisis impact the global economy?

A. The crisis led to a global economic downturn, with consequences such as widespread unemployment, stock market declines, and a credit crunch. Businesses faced difficulties securing financing, and the resulting recession had a lasting impact on households and businesses globally.

Q7. What were the long-term effects of the Global Financial Crisis?

A. The crisis prompted widespread public indignation and efforts to reform financial regulations. The Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 aimed to prevent a recurrence by implementing measures to restrict risky activities by major banks and enhance consumer protection. The crisis also emphasized the need for vigilant oversight and international cooperation to prevent excessive risk-taking.

Q8. How did the lessons learned from the crisis influence financial institutions and regulations?

A. The crisis led to improved risk management practices, with a focus on accuracy, stress testing, and liquidity risk. Financial regulations were enhanced globally, with initiatives like Basel III introducing more stringent capital requirements and liquidity standards. Policymakers recognized the interconnected nature of global financial markets, leading to increased international cooperation to address systemic risks.

Q9. How long did it take for the global economy to recover from the crisis?

A. The recovery from the Global Financial Crisis was slow and varied by region. Some economies rebounded more quickly than others, and persistent challenges such as high unemployment and government debt levels influenced the pace of recovery. The experience shaped discussions on the role of government intervention and the need for a coordinated approach to crisis management.

Q10. What is the legacy of the Global Financial Crisis on the financial system and global economy?

A. The crisis left a lasting impact, prompting reforms, changes in risk management practices, and a more resilient financial system. The interconnectedness of global financial markets remains a focal point for policymakers, emphasizing the need for continued international cooperation to address systemic risks. The lessons learned continue to shape discussions on economic policies and crisis management strategies.