Introduction:

In the fast-paced world of finance, one name stands out as an enduring symbol of success: Warren Buffett. Often hailed as the Oracle of Omaha, Buffett’s investment strategies have not only amassed him immense wealth but have also become a beacon for aspiring investors worldwide. In this blog post, we delve into the core principles that have guided Buffett’s investment journey, backed by real-life examples and his own words of wisdom.

1. Value Investing: Unearthing Diamonds in the Rough

At the core of Warren Buffett’s investment strategy lies the timeless principle of value investing. Unlike many investors who chase after trending stocks or quick profits, Buffett’s approach is grounded in fundamental analysis and a keen eye for undervalued assets. Value investing is not just about buying cheap stocks; it’s about identifying companies that are trading below their intrinsic value, considering their potential for future growth and profitability.

Warren Buffett, often regarded as the epitome of a value investor, doesn’t merely look at stock prices. Instead, he delves deep into a company’s financial statements, scrutinizing its earnings, assets, liabilities, and overall business model. He seeks out companies with strong fundamentals – stable revenue, consistent earnings, low debt, and a competitive edge in their industry. These fundamentals serve as the bedrock upon which he builds his investments.

The Coca-Cola Coup: A Masterstroke in Value Investing

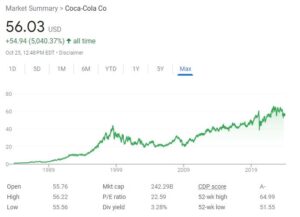

One of the most iconic examples of Buffett’s value investing prowess occurred in the early 1980s when he recognized the intrinsic value of Coca-Cola, the global beverage giant. While the market might have undervalued Coca-Cola at that time, Buffett saw the company’s enduring brand, wide market presence, and unwavering consumer demand as indicators of its intrinsic value. He famously remarked, “I don’t see how you can go wrong with Coke.”

Buffett’s decision to invest substantially in Coca-Cola was not a gamble; it was a calculated move based on the company’s strong fundamentals and long-term potential. He understood that people worldwide have an almost unshakeable loyalty to the brand, ensuring a consistent demand for its products regardless of economic fluctuations. This insight allowed him to invest with confidence, knowing that he was putting his money into a company with a robust moat, an enduring competitive advantage that protected it from competitors.

The Power of Identifying Undervalued Assets

Buffett’s success with Coca-Cola underscores the power of identifying undervalued assets. By seeing beyond the surface and recognizing the intrinsic worth of a company, he was able to make a substantial investment that paid off handsomely over the years. This approach is not about timing the market or following market trends; it’s about a deep understanding of a company’s fundamentals and a conviction in its long-term potential.

2. Moat Investing: Building Fortresses in the Business World

Warren Buffett’s investment strategy is often likened to that of a medieval king protecting his kingdom. Instead of physical walls, Buffett builds economic moats around his investments – metaphorical fortresses that safeguard companies from the onslaught of competition. This concept of economic moats, the competitive advantages that make it difficult for rival companies to encroach upon a business’s market share and profitability, lies at the heart of Buffett’s investment philosophy.

Understanding Economic Moats: The Key to Long-Term Success

Economic moats come in various forms, and Buffett’s genius lies in recognizing and capitalizing on these advantages. One of the most prominent types of moat is brand recognition. A strong, trusted brand creates a psychological barrier, making consumers loyal even when similar, cheaper alternatives exist. Buffett’s investment in American Express perfectly illustrates this. Despite a crisis in the 1960s when the company was hit hard, he saw beyond the temporary setbacks and recognized the enduring power of the American Express brand.

The American Express Saga: A Testament to Moat Investing

Buffett’s steadfast faith in American Express during its darkest hour showcases his commitment to businesses with unassailable moats. He famously said, “In business, I look for economic castles protected by unbreachable ‘moats’.” The metaphor is strikingly apt – just as a castle’s moat protects it from invaders, economic moats protect companies from competitors.

Despite the crisis, Buffett believed in the enduring strength of American Express’s brand moat. The company’s long history, customer trust, and widespread acceptance bolstered his confidence. While short-term investors panicked, Buffett saw an opportunity. He didn’t just weather the storm; he fortified his position, recognizing that the brand moat would eventually see American Express through troubled waters. This faith was not misplaced; over time, the company recovered and prospered, rewarding Buffett’s conviction with substantial returns.

The Rewards of Moat Investing: Patience and Long-Term Gains

Buffett’s success with moat investing underscores the importance of patience in the world of finance. While others may focus on short-term gains, Buffett’s approach is to invest in companies that have enduring competitive advantages. Economic moats are not built overnight; they are the result of years, sometimes decades, of consistent performance, customer trust, and innovation. Investors who understand this principle, like Buffett, are willing to wait, knowing that the rewards of investing in companies with unbreachable moats are often reaped over the long term.

3. Long-Term Perspective: The Patient Investor’s Triumph

In the fast-paced world of finance, where markets can swing wildly from day to day, Warren Buffett stands as a beacon of patience and long-term vision. His philosophy, encapsulated in the adage, “The stock market is designed to transfer money from the Active to the Patient,” highlights the transformative power of a long-term perspective. This wisdom is not just a mantra but a guiding principle that has earned him substantial wealth and made him a role model for investors worldwide.

Buffett’s Apple Odyssey: A Testament to Patience

Buffett’s investment in Apple Inc., which began in 2016 and has continued to flourish, serves as a prime example of his unwavering patience and belief in the long-term potential of a company. Despite the market’s inherent volatility and the occasional turbulence that even a tech giant like Apple faces, Buffett held steadfast to his shares. His approach defies the impulsive nature of many investors who react hastily to short-term market fluctuations.

During times when the stock market experienced fluctuations due to various factors such as economic uncertainties, geopolitical events, or shifts in consumer sentiment, Buffett remained resolute. He understood that market noise and short-term volatility are mere ripples in the vast sea of a company’s long-term journey. By not succumbing to the emotional roller-coaster of market dynamics, he showcased the power of enduring these fluctuations for the promise of substantial, long-term gains.

The Rewards of Endurance: Building Wealth Over Time

Buffett’s commitment to long-term investments isn’t just about weathering storms; it’s about reaping the rewards that come from enduring market uncertainties. By embracing the concept of delayed gratification, he has consistently outperformed the market and achieved impressive compounded returns over several decades. For individual investors, this approach offers a vital lesson: the true potential of investments often reveals itself over time.

While short-term gains might be enticing, the real wealth-building power lies in patiently nurturing investments, allowing them to grow and compound over the years. By holding onto high-quality assets, investors have the opportunity to benefit from the organic growth of businesses, capitalize on dividends, and ride the upward trajectory of the stock market.

The Lesson for Investors: Embrace the Marathon, Not the Sprint

In a world where instant gratification often takes precedence, Buffett’s long-term perspective serves as a reminder that successful investing is more akin to running a marathon than a sprint. It’s about having the patience to stay invested, allowing time to work its magic, and reaping the rewards of enduring faith in fundamentally sound companies.

For investors aiming to secure their financial future, Buffett’s approach offers a valuable lesson: resist the allure of quick profits, focus on companies with strong fundamentals, and have the patience to let investments grow. By adopting this patient mindset, investors can navigate the market’s short-term fluctuations with confidence, knowing that the true wealth lies in the enduring power of a long-term perspective.

4. Quality Over Quantity: The Art of Discerning Investments

In the vast landscape of investment opportunities, Warren Buffett’s strategy stands out as a beacon of wisdom: quality over quantity. Rather than spreading his investments thin across numerous companies, Buffett concentrates his resources in a select few. His approach mirrors the age-old adage: “It’s not about how many eggs you have; it’s about how well you nurture the ones you do.” This discerning philosophy emphasizes a deep understanding of the businesses he invests in, leading to a profound insight into the essence of successful investing.

Buffett’s IBM Affair: A Lesson in Understanding

Buffett’s investment in IBM exemplifies his quality-centric approach. His decision was not based on market trends, but on a profound understanding of the company’s core business and its future trajectory. He comprehended IBM’s position in the rapidly evolving tech landscape, its innovative strengths, and its ability to adapt to changing market demands. In essence, he saw not just the present value, but the potential future value of the company. His investment wasn’t a shot in the dark; it was a carefully calculated move rooted in deep understanding and analysis.

The Wisdom of Knowing: Mitigating Risks Through Understanding

Warren Buffett’s assertion, “Risk comes from not knowing what you’re doing,” underscores the essence of his approach. For him, ignorance is the true peril in investing. Blindly following trends, speculating on hearsay, or investing in businesses one doesn’t comprehend can lead to catastrophic financial consequences. Buffett’s methodical strategy hinges on detailed research, meticulous analysis, and a profound understanding of a company’s fundamentals.

By diving into a company’s financial reports, scrutinizing its business model, understanding its competitive advantages, and evaluating its management team, Buffett mitigates risks. This knowledge arms him against market uncertainties and economic fluctuations. It allows him to make informed decisions based on real data and insights rather than emotional impulses or speculative trends.

In-Depth Research: The Cornerstone of Wise Investment Choices

In-depth research isn’t just a part of Buffett’s decision-making process; it’s the cornerstone. It’s the countless hours spent poring over annual reports, studying market trends, and understanding consumer behavior. It’s the deep dives into a company’s history, its competitors, and its innovations. This meticulous approach isn’t just a preference; it’s a necessity. For investors inspired by Buffett’s success, it’s a lesson that shortcuts have no place in the realm of wise investing.

In a world where quick trades and instant gains often dominate headlines, Warren Buffett’s philosophy reminds us of the enduring value of patient, informed decision-making. Quality investments, rooted in understanding and analysis, not only stand the test of time but also become the bedrock of enduring wealth. Through Buffett’s lens, investors learn that in the realm of finance, knowledge truly is power, and quality always triumphs over quantity.

5. Risk Management: Buffett’s Shield Against Financial Storms

In the unpredictable world of finance, where risks lurk around every corner, Warren Buffett’s approach to risk management shines as a beacon of prudence and wisdom. His strategy is straightforward, yet profoundly effective, emphasizing caution, understanding, and a healthy margin of safety. This approach acts as a shield, protecting his investments against the whims of the market and the volatility of economic storms.

Avoiding the Abyss: Prudent Decision-Making

One of Buffett’s key principles in risk management is his aversion to speculative investments and businesses he doesn’t understand. While the allure of quick profits might tempt many, Buffett steers clear of ventures that lack a solid foundation. He understands that investing in complex financial instruments or obscure businesses increases the risk exponentially. By staying within the boundaries of his expertise, he minimizes the chances of falling into the abyss of financial uncertainty.

The Margin of Safety: A Pillar of Buffett’s Strategy

Central to Buffett’s risk management philosophy is the concept of a margin of safety. This principle dictates that an investor should buy a security only when its market price is significantly below its intrinsic value. In simpler terms, it’s akin to buying a dollar for fifty cents. This buffer acts as a cushion against unforeseen market fluctuations. By adhering to this principle, Buffett adds a layer of protection to his investments, reducing the impact of market downturns.

The Goldman Sachs Gamble: A Calculated Risk

A vivid illustration of Buffett’s risk management strategy can be found in his investment decisions during the 2008 financial crisis. While many investors were fleeing the market in panic, Buffett saw an opportunity. His careful evaluation of the risks involved allowed him to make a calculated investment in Goldman Sachs, a prominent investment bank facing the brunt of the crisis. Understanding the company’s core operations, its risk exposure, and its long-term potential, he made a move when others were paralyzed by fear.

Buffett’s investment in Goldman Sachs exemplifies the essence of his risk management philosophy. Instead of succumbing to market hysteria, he remained calm and rational. His in-depth analysis of the risks involved allowed him to discern between a temporary setback and a fundamentally flawed business. This discernment between perceived risk and actual risk is a hallmark of his approach.

Conclusion: The Prudent Path to Prosperity

Warren Buffett’s approach to risk management teaches us that successful investing isn’t about avoiding risks altogether; it’s about understanding them. By embracing prudent decision-making, avoiding the unknown, and ensuring a margin of safety, investors can navigate the volatile seas of the financial world with confidence. In a realm often driven by emotion and speculation, Buffett’s strategy offers a reassuring reminder that careful evaluation, grounded in knowledge and analysis, is the key to not just surviving, but thriving, even in the face of adversity.

6. Continuous Learning: The Lifelong Journey of Warren Buffett

Warren Buffett’s success story is not just about astute investments and financial acumen; it’s equally a tale of continuous learning, intellectual curiosity, and an insatiable appetite for knowledge. His commitment to lifelong learning is a cornerstone of his remarkable success in the world of finance, and it stands as an inspiring lesson for aspiring investors and lifelong learners alike.

The Voracious Reader: Buffett’s Literary Odyssey

Buffett is renowned for his voracious reading habits. He devours books, not just on finance and investments, but on a wide array of topics spanning history, psychology, science, and technology. His reading list is diverse, reflecting his keen interest in understanding the world from multiple perspectives. By staying well-informed about global events, market trends, and emerging technologies, Buffett remains ahead of the curve in the ever-changing landscape of investments.

The Power of Broad Knowledge: Expertise Across Sectors

Buffett’s knowledge isn’t confined to a single niche; it’s broad and multidisciplinary. He possesses insights not only into financial markets but also into various sectors such as technology, consumer goods, energy, and healthcare. This wide-ranging expertise allows him to identify emerging opportunities, anticipate market shifts, and make informed investment decisions in diverse industries.

“The More You Learn, the More You Earn”: Wisdom in Words

Buffett’s famous mantra, “The more you learn, the more you earn,” encapsulates the essence of his approach. He understands that knowledge is not just power; it’s wealth. By continuously expanding his understanding of the world, he enriches his investment decisions. This wisdom isn’t limited to financial gains; it extends to life itself. Buffett’s dedication to learning is a testament to the idea that curiosity is the driving force behind progress and prosperity.

Inspiring Others: Encouraging a Culture of Learning

Buffett’s commitment to continuous learning isn’t selfish; it’s a beacon that guides others. His emphasis on reading, education, and intellectual growth has inspired countless individuals worldwide. He encourages aspiring investors to pick up books, engage with new ideas, and never stop exploring. In a world where knowledge is easily accessible, Buffett’s advocacy for continuous learning serves as a reminder that the pursuit of wisdom is an ongoing journey, open to anyone willing to embark on it.

Conclusion:

Warren Buffett’s investment strategies are not just a roadmap to financial success; they are a testament to the power of patience, research, and continuous learning. By understanding the principles of value investing, recognizing economic moats, embracing a long-term perspective, focusing on quality, managing risks, and dedicating oneself to continuous learning, investors can navigate the complexities of the stock market with confidence.

Related articles:

Investing in Sustainable Stocks: Opportunities in the US Market

How to Use Stock Screeners to Find Investment Opportunities in the USA Stock Market

Recommended Reading:

For readers eager to delve deeper into Warren Buffett’s investment strategies, here are a few essential books and articles:

- “The Intelligent Investor” by Benjamin Graham: This classic book on value investing laid the foundation for Buffett’s approach.

- “Buffett: The Making of an American Capitalist” by Roger Lowenstein: A comprehensive biography offering insights into Buffett’s life and investment strategies.

- Berkshire Hathaway Annual Letters: Buffett’s annual letters to shareholders are a goldmine of wisdom, providing a direct window into his thoughts and strategies.

Invest wisely and remember, as Warren Buffett says, “The best investment you can make is in yourself.” Happy investing!