Black Monday refers to October 19, 1987, a day that witnessed one of the most significant stock market crashes in history. On that fateful Monday, global financial markets experienced a sudden and severe downturn, leading to a dramatic drop in stock prices. The term “Black Monday” is often used to describe this event because of the extreme losses and panic that characterized the day.

Several factors contributed to the crash, including concerns about rising interest rates, global economic uncertainties, and the use of computerized trading strategies. The use of program trading, which involved the use of computer algorithms for large-scale trading, exacerbated the selling pressure and contributed to the rapid decline in stock prices.

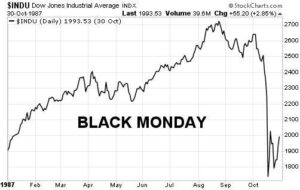

On Black Monday, the Dow Jones Industrial Average (DJIA) in the United States plummeted by a staggering 22%, marking the largest single-day percentage loss in its history. The crash had a profound impact on financial markets worldwide, triggering a wave of selling across international exchanges.

Despite the severity of Black Monday, the global economy did not experience a prolonged recession. Central banks, including the Federal Reserve, intervened to stabilize financial markets, and policymakers implemented measures to restore confidence. Over time, stock markets recovered, and the incident led to increased awareness about the need for improved risk management in financial markets.

The events of Black Monday prompted regulatory changes and the development of circuit breakers, mechanisms designed to temporarily halt trading during periods of extreme market volatility. These measures aimed to prevent panic selling and provide a cooling-off period for investors.

Black Monday serves as a reminder of the inherent risks in financial markets and the potential for rapid and unexpected downturns. It also underscores the importance of prudent financial regulation and risk management practices to maintain the stability of global financial systems.

Causes of Black Monday (1987)

Program Trading

- Automated Trading Strategies:

- In the 1980s, the use of computer algorithms to execute trades, known as program trading, became increasingly prevalent. These automated strategies allowed for the execution of large volumes of trades at high speeds.

- Program trading encompassed various algorithms designed to respond to specific market conditions or trigger events. These algorithms could automatically execute buy or sell orders based on predetermined criteria.

- Market Impact:

- On Black Monday, program trading played a significant role in exacerbating the market decline. Automated sell orders were triggered by specific conditions, such as a certain percentage decline in stock prices or other predetermined criteria.

- The simultaneous execution of these automated sell orders contributed to a cascade of selling, overwhelming the market with an unprecedented volume of sell orders. This intensified the downward pressure on stock prices and contributed to the rapid and widespread decline.

Overvaluation

- High Valuations:

- Prior to Black Monday, stock markets, particularly in the United States, had experienced a period of rapid and substantial growth. This bull market led to elevated stock valuations, with some stocks trading at historically high price-to-earnings ratios.

- Investors were paying a premium for stocks, and the market became susceptible to a correction as valuations outpaced underlying economic fundamentals.

- Market Sentiment:

- Overvaluation created a situation where market sentiment became fragile. Investors began to perceive that stock prices were disconnected from economic realities, leading to concerns about a potential market bubble.

- Fragile market sentiment meant that any negative news or trigger event could prompt a sudden and severe correction as investors reevaluated the sustainability of high valuations.

Global Economic Imbalances

- Trade Deficits and Exchange Rates:

- Global economic imbalances, including trade deficits and exchange rate fluctuations, added to the uncertainty leading up to Black Monday. Trade imbalances among countries and concerns about currency values created a backdrop of economic instability.

- Trade deficits and currency issues contributed to nervousness in financial markets, as these imbalances could impact global economic conditions and financial markets.

- Interconnected Markets:

- The interconnectedness of global financial markets meant that events in one part of the world could quickly impact markets elsewhere. Information and trading activities could spread rapidly across borders, leading to a globalized response to economic and financial developments.

- The fear of a global economic slowdown, possibly triggered by trade imbalances and currency concerns, exacerbated the sell-off on Black Monday as investors reacted to the interconnected nature of global markets.

In summary, the causes of Black Monday in 1987 were multifaceted. Program trading, characterized by automated trading strategies, contributed to the rapid and widespread decline in stock prices. Overvaluation of stocks, driven by a period of rapid market growth, created fragile market sentiment. Global economic imbalances, including trade deficits and currency concerns, added to the uncertainty, and the interconnectedness of global markets amplified the sell-off on Black Monday. The convergence of these factors resulted in a historic market crash with far-reaching consequences.

How Black Monday (1987) Happened

On October 19, 1987, stock markets around the world experienced a significant one-day decline, commonly referred to as Black Monday. The Dow Jones Industrial Average in the United States, for instance, recorded a historic drop, losing about 22% of its value in a single day.

Related Article: Warren Buffet’s Investment Strategies

Panic Selling

- Widespread Panic:

- On Black Monday, the trading day was marked by a pervasive sense of panic among investors. The market sentiment shifted dramatically, and fear gripped investors who were alarmed by the speed and magnitude of the market decline.

- The widespread panic selling was not limited to a specific group of investors; it affected institutional and individual investors alike. The fear of sustaining further losses prompted a rush to liquidate holdings, contributing to the intensity of the sell-off.

- Liquidity Crisis:

- The sheer volume of selling overwhelmed the market’s capacity to absorb the trades. The rapid and simultaneous selling across various markets and asset classes created a liquidity crisis.

- A liquidity crisis occurs when there is an imbalance between the supply and demand for securities. As sell orders flooded the market, there were limited buyers, resulting in a scarcity of liquidity. This scarcity, in turn, led to sharp and abrupt price declines.

Market Mechanisms

- Role of Program Trading:

- Program trading, characterized by the use of automated trading strategies, played a significant role in the market decline on Black Monday. These automated strategies executed sell orders triggered by specific market conditions or predetermined criteria.

- The role of program trading was critical in accelerating the selling. Automated algorithms executed trades at a pace that outstripped the ability of the market to adjust, contributing to the rapid and widespread decline in stock prices.

- Lack of Circuit Breakers:

- Unlike in later years, there were no circuit breakers or trading halts in place to temporarily stop trading during extreme market volatility. Circuit breakers are mechanisms designed to pause trading temporarily when predefined market conditions are met, providing an opportunity for investors to reassess and prevent further panic selling.

- The absence of circuit breakers on Black Monday allowed the sell-off to continue unabated. The continuous selling without a break contributed to the severity of the market decline and prolonged the period of panic in the absence of mechanisms to temporarily halt trading.

Immediate Impact

- The confluence of panic selling, a liquidity crisis, and the role of program trading created an environment of extreme market stress. Investors faced significant losses, and financial institutions grappled with the challenges of navigating the turbulent market conditions.

- The lack of market mechanisms to address extreme volatility meant that the selling pressure was not mitigated, leading to a historic drop in the Dow Jones Industrial Average and other major indices.

Aftermath

- In the aftermath of Black Monday, financial markets were in disarray. Authorities, including central banks, intervened to stabilize financial markets and restore confidence.

- The event had a lasting impact on market structure and risk management. Subsequent reforms, including the implementation of circuit breakers and other measures, were introduced to address the shortcomings highlighted by the events of Black Monday.

In summary, Black Monday in 1987 was characterized by panic selling, a liquidity crisis, and the absence of market mechanisms like circuit breakers. The rapid and simultaneous decline in stock markets around the world highlighted vulnerabilities in market structure and led to subsequent reforms to enhance risk management and address extreme market volatility.

Related Article: Building Financial Resilience: The Importance of an Emergency Fund

Recovery from Black Monday (1987)

Central Bank Intervention

- Policy Response:

- In the aftermath of Black Monday, central banks, including the U.S. Federal Reserve, responded swiftly to stabilize financial markets. Recognizing the severity of the crisis, these institutions took measures to address the strains in the financial system and prevent a complete collapse.

- The policy response included providing liquidity to the financial system, ensuring that banks and financial institutions had access to funds to meet their obligations and maintain stability.

- Interest Rate Cuts:

- Central banks implemented interest rate cuts as a tool to encourage borrowing and spending. Lower interest rates make borrowing more attractive, leading to increased consumer spending and business investment.

- The goal of interest rate cuts was to stimulate economic activity, offset the negative impact of the market crash, and prevent a prolonged economic downturn. By making credit more accessible, central banks aimed to support a recovery in both financial markets and the broader economy.

Global Economic Rebound

- Short-Term Impact:

- The intervention by central banks had a notable short-term impact. The immediate goal was to calm financial markets and restore some level of confidence among investors and institutions.

- By providing liquidity and implementing measures to stabilize the financial system, central banks were able to mitigate the immediate risks of a complete market collapse. This intervention helped prevent a cascading series of failures that could have had severe and lasting consequences.

- Broader Economic Recovery:

- While the short-term impact was significant, the recovery from Black Monday was not instantaneous. It took time for markets to fully stabilize, and the broader economic recovery unfolded gradually.

- Economic policies and fiscal stimulus measures played a crucial role in supporting the broader recovery. Governments implemented measures to boost economic activity, including infrastructure spending, tax incentives, and social programs.

- Gradual Rebuilding of Investor Confidence:

- Investor confidence, which had been severely shaken by the events of Black Monday, gradually began to rebuild. As financial markets stabilized and the global economy showed signs of recovery, investors gained more confidence in the prospects for economic growth and stability.

- The gradual rebuilding of investor confidence was a key factor in sustaining the recovery. As confidence returned, investors became more willing to participate in financial markets, supporting asset prices and contributing to the overall economic recovery.

Related Article: How Geopolitical Events Affect Global Markets

Lessons from Black Monday (1987)

Importance of Circuit Breakers

- Preventing Panic Selling:

-

- The events of Black Monday emphasized the critical importance of circuit breakers or trading halts in preventing panic selling during extreme market conditions. Circuit breakers are mechanisms designed to temporarily pause trading when predefined market conditions are met, providing a breather for investors to reassess their positions and prevent further irrational behavior.

- By interrupting trading during periods of extreme volatility, circuit breakers aim to break the cycle of panic selling and create an opportunity for market participants to digest information, evaluate market conditions, and make more informed decisions.

Need for Coordinated Global Responses

- Interconnected Markets:

- Black Monday highlighted the interconnected nature of global financial markets. The swift transmission of market stress across borders underscored that events in one part of the world could have rapid and far-reaching effects on markets elsewhere.

- The realization of the interconnectedness of markets highlighted the need for a coordinated global response to financial crises. What starts as a localized event can quickly escalate into a global issue, affecting economies and financial systems around the world.

- Communication and Cooperation:

- The importance of communication and cooperation among central banks and financial institutions in different countries became a central lesson from Black Monday. Coordinated efforts were recognized as essential to address cross-border financial challenges and prevent the spread of financial contagion.

- Central banks and financial authorities needed to share information, coordinate policy responses, and work together to stabilize global financial markets. Open lines of communication and collaborative efforts became critical tools in managing the fallout from financial crises.

Legacy and Impact

- The lessons learned from Black Monday led to significant changes in market regulation and risk management practices. Subsequent to the crash, many financial regulators around the world implemented or strengthened circuit breaker mechanisms to address extreme market volatility.

- The need for coordinated global responses became a guiding principle in addressing future financial crises. International institutions, such as the International Monetary Fund (IMF) and the Bank for International Settlements (BIS), played a more active role in facilitating communication and cooperation among central banks.

- The lessons from Black Monday also influenced the development of financial market infrastructure, risk management protocols, and the establishment of international forums for collaboration. The goal was to create a more resilient and interconnected global financial system that could withstand shocks and respond effectively to crises.

In summary, Black Monday in 1987 left a lasting legacy by imparting crucial lessons about the importance of circuit breakers in preventing panic selling and the necessity for coordinated global responses to financial crises. These lessons influenced reforms in market structures, regulatory frameworks, and international cooperation to enhance the stability and resilience of the global financial system.

Related Article: The Wall Street Crash of 1929 (Great Depression)

Related Video Link: What happened on Black monday?