In the unpredictable world of investments, the old saying, “Don’t put all your eggs in one basket,” holds more truth than ever before. Diversification, the strategic spreading of investments across different assets and sectors, is the key to reducing risk and ensuring long-term financial stability. This fundamental principle of finance empowers investors to manage and mitigate risks effectively, regardless of market fluctuations or economic uncertainties.

Understanding Diversification: A Shield Against Volatility

Diversification is akin to a financial safety net, protecting investors from the inherent volatility of financial markets. Instead of concentrating investments in a single asset class, such as stocks or real estate, diversification involves allocating resources across various sectors, industries, and geographical regions. This broad approach minimizes the impact of a poor-performing asset on an entire investment portfolio.

Types of Diversification

1. Asset Class Diversification:

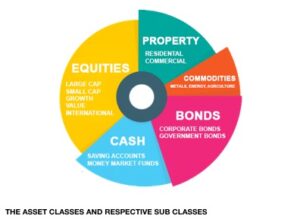

Asset class diversification involves spreading investments across various types of assets. These assets can include stocks, bonds, real estate properties, and commodities like gold or oil. Each asset class behaves differently in response to economic events. For instance, during economic downturns, investors tend to move their funds from volatile stocks to safer assets like bonds. By diversifying across multiple asset classes, investors create a safety net for their investments. When one class underperforms, gains in other classes can help balance the overall portfolio, minimizing losses and stabilizing returns.

-

Stocks

Stocks, also known as equities, represent ownership in a company. When an investor buys shares of a company’s stock, they become a partial owner of that company. Stocks have the potential for high returns, but they also come with higher volatility and risk. Different types of stocks, such as large-cap, mid-cap, and small-cap stocks, offer varying levels of risk and return, allowing investors to diversify within the stock market itself.

-

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When an investor buys a bond, they are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are generally considered safer than stocks and provide a predictable income stream. They are often included in portfolios to provide stability and reduce overall risk.

- Real Estate Properties

Real estate properties include physical assets such as residential homes, commercial buildings, and land. Real estate can be a valuable addition to an investment portfolio because it tends to appreciate over time. Rental properties can also generate a steady income stream through rental payments. Real estate investments offer diversification benefits because they often have a low correlation with stocks and bonds, meaning they may perform differently under various market conditions.

-

Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, oil, natural gas, agricultural products, and metals. Investing in commodities can serve as a hedge against inflation and currency fluctuations. Gold, for example, is often considered a safe-haven asset during economic uncertainties. Oil and natural gas, on the other hand, are essential energy commodities that can provide diversification benefits due to their unique market dynamics.

- Mutual Funds and Exchange-Traded Funds (ETFs)

Mutual funds and ETFs allow investors to pool their money together to invest in a diversified portfolio of assets. Mutual funds are managed by professional fund managers, who invest in a variety of securities based on the fund’s objectives. ETFs are similar but are traded on stock exchanges like individual stocks. Both mutual funds and ETFs provide an opportunity for investors to diversify across a wide range of assets without having to individually purchase each asset.

- Cash and Cash Equivalents

Cash and cash equivalents include assets like savings accounts, money market funds, and Treasury bills. These assets are highly liquid and low-risk, providing a safe place to park funds temporarily. While they may not offer significant returns, they play a crucial role in providing liquidity and stability to an investment portfolio.

In a diversified portfolio, these various assets are strategically combined to spread risk and enhance the potential for stable, long-term returns. The specific allocation of these assets depends on an investor’s financial goals, risk tolerance, and investment horizon, allowing for a tailored approach to wealth management and financial security.

2. Sector Diversification:

Sector diversification refers to investing in different sectors of the economy, such as technology, healthcare, energy, and consumer goods. Economic sectors do not perform uniformly; they have their unique cycles and respond differently to market forces. By diversifying across sectors, investors can reduce the risk associated with a specific sector’s downturn. For example, if the technology sector faces a slump due to regulatory changes, investments in stable sectors like healthcare can offset potential losses, providing a more stable overall portfolio.

Key Sectors in the Economy:

-

Technology

The technology sector comprises companies involved in the development, manufacturing, and distribution of technology products and services. This includes software developers, hardware manufacturers, internet companies, and telecommunications firms. Technology companies often experience rapid innovation and growth, making them attractive investment options, but they can also be volatile due to market competition and changing consumer preferences.

-

Healthcare

The healthcare sector encompasses companies involved in medical services, pharmaceuticals, biotechnology, and healthcare equipment. Demand for healthcare services and products remains relatively stable even during economic downturns, making this sector defensive. Healthcare companies often benefit from advancements in medical research and an aging population, making them a popular choice for investors seeking stability in their portfolios.

-

Energy

The energy sector includes companies engaged in the exploration, production, refining, and distribution of energy resources such as oil, natural gas, and renewable energy sources. Energy companies are influenced by factors such as geopolitical events, supply and demand dynamics, and government regulations. Given the global importance of energy, this sector plays a significant role in many diversified portfolios.

- Consumer Goods

The consumer goods sector comprises companies that produce non-durable goods (like food, beverages, and toiletries) and durable goods (such as appliances, electronics, and automobiles) for consumers. Consumer spending drives this sector, making it an essential part of the economy. Companies in this sector are influenced by consumer trends, economic conditions, and market competition.

3. Geographical Diversification:

Geographical diversification involves investing in different countries or regions. Economic, political, and currency-related issues can significantly impact a specific country’s market. By spreading investments globally, investors can mitigate the risk associated with a particular country’s economic challenges. For instance, if one country’s economy experiences a recession, investments in countries with growing economies can help balance the overall performance of the portfolio.

Benefits of Geographical Diversification:

- Risk Mitigation

Economic and political events within a specific country, such as regulatory changes, political instability, or currency devaluation, can significantly impact local investments. Geographical diversification helps mitigate these risks. If one country’s economy is underperforming, investments in countries with stronger economies can potentially offset losses.

- Currency Risk Management

Currencies fluctuate in value due to various factors like interest rates, inflation, and political stability. Investing in different countries allows investors to spread their exposure to different currencies. This diversification can act as a hedge against adverse movements in any single currency, protecting the overall value of the portfolio.

- Access to Growth Opportunities

Different countries experience different growth rates based on their economic activities, demographics, and technological advancements. Geographical diversification enables investors to tap into emerging markets and industries that might not be available or as prominent in their home country. This access to diverse growth opportunities can enhance the overall performance of the portfolio.

- Political and Regulatory Diversification

Political events and regulatory changes can impact investments significantly. By diversifying across countries, investors reduce the risk associated with political decisions that may affect specific industries or companies. Regulations that affect one region may not have the same impact on investments in another region, providing a level of stability to the overall portfolio.

Considerations in Geographical Diversification

- Economic Analysis

Investors need to analyze the economic fundamentals of different countries, including GDP growth, inflation rates, employment data, and trade balances. Understanding these factors helps in making informed decisions about geographical allocations.

- Political Stability

Stable political environments are generally more conducive to economic growth. Investors should consider the political stability of countries when diversifying geographically to avoid regions with high political risk.

- Cultural and Market Differences

Cultural factors and market nuances can influence consumer behavior and business practices. Investors need to consider these differences when expanding into new markets to ensure their investments align with local market demands and cultural preferences.

4. Company Diversification:

Within the stock market, diversification can occur by investing in shares of various companies. Stocks are categorized into large-cap (large, established companies), mid-cap (mid-sized companies), and small-cap (smaller, emerging companies). Each category has its risk and return profile. By balancing investments across these categories, investors can mitigate risks associated with the size and stability of companies. Large-cap stocks often offer stability, while small-cap stocks may provide high growth potential. A well-diversified stock portfolio includes a mix of these categories, ensuring a balanced risk exposure.

1. Large-Cap Stocks:

Large-cap stocks refer to shares of well-established, financially stable companies with a market capitalization typically exceeding $10 billion. Market capitalization is calculated by multiplying the company’s stock price by its total outstanding shares. Large-cap companies are industry leaders with a proven track record of stability and reliability. They often have a substantial market presence, widespread brand recognition, and diverse revenue streams.

Characteristics:

- Stability: Large-cap companies are generally stable and mature, having weathered various market cycles.

- Dividends: They often pay regular dividends to shareholders, providing a steady income stream.

- Lower Volatility: Large-cap stocks tend to be less volatile than smaller counterparts, making them attractive to conservative investors.

- Market Dominance: These companies are usually leaders in their industries, enjoying a significant market share.

2. Mid-Cap Stocks:

Mid-cap stocks represent shares of companies with a market capitalization typically ranging from $2 billion to $10 billion. Mid-cap companies are often in a phase of expansion and growth. They have moved beyond the risky startup phase but are still striving for further expansion and market penetration.

Characteristics:

- Growth Potential: Mid-cap stocks offer higher growth potential than large-cap stocks because these companies are still in a phase where they can expand their market presence and increase their earnings significantly.

- Moderate Volatility: While mid-cap stocks are generally more volatile than large-cap stocks, they offer a balance between growth potential and risk, making them attractive to investors seeking moderate risk.

- Innovation: Many mid-cap companies are innovators in their respective industries, introducing new products and services to the market.

3. Small-Cap Stocks:

Small-cap stocks are shares of companies with a market capitalization typically below $2 billion. These companies are often in the early stages of development, striving to establish themselves in the market. Small-cap stocks can offer high growth potential, but they come with increased volatility and risk.

Characteristics:

- High Growth Potential: Small-cap stocks have the potential for rapid growth, especially if the company’s products or services gain traction in the market.

- Volatility: Small-cap stocks are more volatile than large-cap and mid-cap stocks. Their prices can fluctuate significantly in response to market sentiment and company-specific news.

- Opportunity for Early Investment: Investing in small-cap stocks provides the opportunity to get in early on companies with innovative ideas and high growth prospects.

Considerations for Investors:

- Risk Tolerance: Investors should consider their risk tolerance and investment objectives when deciding on the mix of large-cap, mid-cap, and small-cap stocks in their portfolios.

- Diversification: Diversifying across these categories can provide a balanced approach, allowing investors to benefit from the stability of large-caps, the growth potential of mid-caps, and the high growth potential (albeit with higher risk) of small-caps.

- Market Research: Thorough research and analysis of individual companies within each category are crucial. Factors such as financial health, management quality, industry trends, and competitive positioning should be evaluated.

5. Time Diversification:

Time diversification involves spreading investments across different time periods. Investors can choose to invest in both short-term and long-term assets. Short-term investments might include assets like certificates of deposit (CDs) or money market funds, which are relatively stable but offer lower returns. Long-term investments, such as stocks and real estate properties, tend to provide higher returns over an extended period, although they come with higher volatility. By diversifying across different time horizons, investors can reduce the impact of market volatility over time. This strategy allows them to balance immediate financial needs with long-term wealth accumulation goals.

In summary, diversification across asset classes, sectors, geographical regions, individual companies, and time periods is a comprehensive approach to managing investment risk. By employing these diversification strategies, investors can create a well-rounded portfolio that is resilient to market fluctuations and better positioned to achieve long-term financial success.

The Benefits of Diversification

1. Risk Mitigation:

Diversification spreads risk across different assets, sectors, and regions. When investments are spread out, the poor performance of a single investment is less likely to significantly impact the entire portfolio. For example, if one industry experiences a downturn, investments in other sectors may still perform well. This risk mitigation strategy helps protect the portfolio from substantial losses and provides a cushion during turbulent market periods.

2. Stable Returns:

A diversified portfolio is designed to achieve a balance between risk and return. By including a variety of assets with different risk profiles, the portfolio can generate more stable returns over time. While certain investments might perform exceptionally well in the short term, diversification ensures that the overall portfolio’s performance is less volatile. Investors can rely on a steadier stream of income and growth, reducing the risk of significant financial setbacks.

3. Capital Preservation:

Diversification plays a crucial role in preserving capital, especially during market downturns. In times of economic uncertainty or financial crises, certain assets might lose value. However, a well-diversified portfolio is better equipped to weather these storms. By minimizing losses, diversification helps protect the capital invested. Preserving capital is essential because it ensures that investors have funds available for future opportunities, preventing the erosion of their investment base.

4. Increased Flexibility:

Diversified investors are more adaptable to changing market conditions. As they have spread their investments across various assets and sectors, they are better positioned to respond to emerging opportunities without exposing themselves to significant risks. For instance, if a new industry or market segment shows promise, diversified investors can reallocate funds without disrupting the overall balance of their portfolio. This flexibility allows them to capitalize on emerging trends and sectors, potentially enhancing their returns while managing risks effectively.

The Risks of Not Diversifying

Those who ignore diversification do so at their peril. Concentrated investments can lead to substantial losses if the chosen asset class or sector underperforms. History is rife with examples of companies, sectors, and even entire economies experiencing downturns, leaving investors with significant financial setbacks.

Strategies for Effective Diversification

1. Asset Allocation:

Determining the appropriate mix of assets is the foundation of a diversified investment strategy. This involves assessing your investment goals, understanding your risk tolerance, and considering your time horizon. Different asset classes, such as stocks, bonds, real estate, and commodities, offer varying levels of risk and return. A balanced allocation across these asset classes is crucial. For example, younger investors with a longer time horizon might allocate a higher percentage to stocks for their potential high returns, while those nearing retirement might allocate more to bonds for stability and income.

2. Regular Rebalancing:

Periodically reviewing and rebalancing your investment portfolio is essential to maintaining the desired asset allocation. Market fluctuations and varying performance among asset classes can cause imbalances in your portfolio over time. For instance, if the stock market experiences significant gains, the equity portion of your portfolio might become disproportionately large. Rebalancing involves selling some of the overperforming assets and reinvesting in underperforming or other asset classes to bring the portfolio back to its intended allocation. Regular rebalancing ensures that your portfolio remains in line with your risk tolerance and investment goals.

3. Professional Advice:

Seeking guidance from financial advisors is invaluable when designing a diversified portfolio. Financial advisors have expertise in analyzing market trends, understanding economic indicators, and assessing individual risk tolerance. They can create a personalized investment plan tailored to your financial objectives. Professional advice helps investors make informed decisions, ensuring that their portfolios are not only diversified but also aligned with their long-term goals and risk appetite.

4. Continuous Research:

Staying informed about market trends, economic indicators, and geopolitical events is essential for making informed diversification decisions. Markets are dynamic, influenced by various factors such as political events, economic reports, and technological advancements. Continuous research allows investors to adapt their portfolios in response to changing market conditions. Understanding how different assets react to specific events helps investors make strategic diversification choices. Being aware of global economic trends and geopolitical developments can provide valuable insights into which sectors or regions might offer growth opportunities or face potential challenges.

Related articles:

How to Use Stock Screeners to Find Investment Opportunities in the USA Stock Market

Fundamental Analysis: Evaluating a Company’s Financial Health

Conclusion:

In the intricate world of investments, diversification stands as the bedrock of prudent financial planning. It’s not just a strategy; it’s a shield against the uncertainties that define the global financial landscape. Investors who grasp the power of diversification not only safeguard their wealth but also position themselves to thrive, regardless of the challenges the market may throw their way. Embracing diversification isn’t just a choice; it’s the most sensible path toward financial security and prosperity in an ever-changing world.

To learn more about diversification: