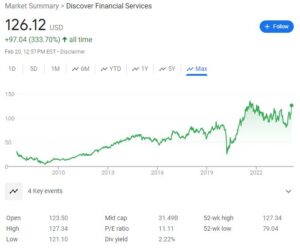

Discover Financial Services Riverwoods (DFS) stands out in the competitive financial landscape with its unique credit card model and focus on direct banking. But how healthy is the company beneath the surface? Let’s dive into a fundamental analysis of DFS, including its latest quarter results.

Financial Performance

- 2023 Highlights: Strong overall performance with record adjusted EPS of $11.26. Revenue jumped 13% year-over-year, driven by loan growth and higher interest rates.

- Profitability: Margins remain healthy, but lower than 2022’s peak. Net interest margin slightly declined to 10.98%, and overall expenses climbed due to compliance and risk management investments.

- Growth: Management expects modest loan growth in 2024 and projects a net interest margin between 10.5% and 10.8%. Earnings are forecast to grow at a steady 8.14% annually.

Discover Financial Services Q4 2023 Results

- Revenue: Up 13% year-over-year to $4.2 billion.

- Net Income: Down 62% year-over-year to $388 million.

- Earnings Per Share (EPS): Down 64% year-over-year to $1.23.

- Loan Growth: Up 15% year-over-year.

- Provision for Loan Losses: Up 100% year-over-year to $1.1 billion.

Strengths

- Strong Brand Recognition: Discover boasts a loyal customer base attracted by its rewards program and focus on responsible lending.

- Direct Banking Model: Less reliant on physical branches, leading to lower costs and operational efficiency.

- Diversification: Beyond credit cards, DFS offers personal loans, student loans, and banking products, mitigating risk.

- Profitable: Historically, DFS has maintained healthy profit margins, exceeding industry averages.

- Technology Focus: Investments in digital platforms and innovation position Discover for future growth.

- Dividend: Offers a reliable dividend with a current yield of 2.22%, attractive to income investors.

Weaknesses

- Limited Market Share: Compared to giants like Visa and Mastercard, DFS has a smaller market share, potentially limiting growth.

- Dependence on Interest Rates: As an interest-driven company, DFS is susceptible to fluctuations in rates.

- Recent Credit Concerns: Rising charge-offs and delinquencies in Q4 2023 raise concerns about credit quality, especially in a potential economic slowdown.

- Limited Geographic Reach: Primarily operates in the U.S., making it vulnerable to domestic economic fluctuations.

- Rising expenses: Investments in technology and compliance are pushing up costs, potentially impacting margins.

- Competition: Faces stiff competition from larger banks and FinTech startups.

- Insider Selling: Recent insider selling activity could signal concerns about future prospects.

Opportunities

- Expansion into New Markets: Potential for international expansion or diversification into new financial products.

- Partnerships: Collaborations with other companies could boost growth and reach new customer segments.

- Digital Growth: Continued investment in digital platforms can attract tech-savvy customers and enhance offerings.

- Acquisitions: Well-chosen acquisitions could bolster DFS’s market share and product offerings.

Threats

- Economic Downturn: Rising interest rates and a potential recession could negatively impact loan growth and credit quality.

- Regulatory Changes: New regulations or scrutiny could increase compliance costs and restrict business activities.

- Technological Disruption: Emerging technologies and FinTech competitors could disrupt traditional banking models.

- Cybersecurity Threats: As a financial institution, DFS is vulnerable to cyberattacks, which could damage its reputation and finances.

Investment Thesis

Discover presents an attractive opportunity for investors seeking a high-yielding dividend and long-term growth potential. However, the current economic climate and rising credit risks warrant careful consideration before investing. A thorough analysis of individual risk tolerance and investment goals is crucial.

The Verdict

While DFS’s Q4 results fell short of expectations, the company’s long-term prospects remain promising. Its strong brand, focus on innovation, and healthy financials provide a solid foundation for future growth. However, investors should be cautious about the potential impact of economic headwinds and rising credit risk.

Further Exploration

- Simply Wall St. Analysis: https://simplywall.st/stocks/us/diversified-financials/nyse-dfs/discover-financial-services

- Alpha Spread Analysis: https://www.alphaspread.com/security/NYSE/DFS/summary

- MarketScreener: https://www.marketscreener.com/quote/stock/DISCOVER-FINANCIAL-SERVIC-52882/

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Related Links:

Fundamental Analysis of Ocugen Inc (OCGN)